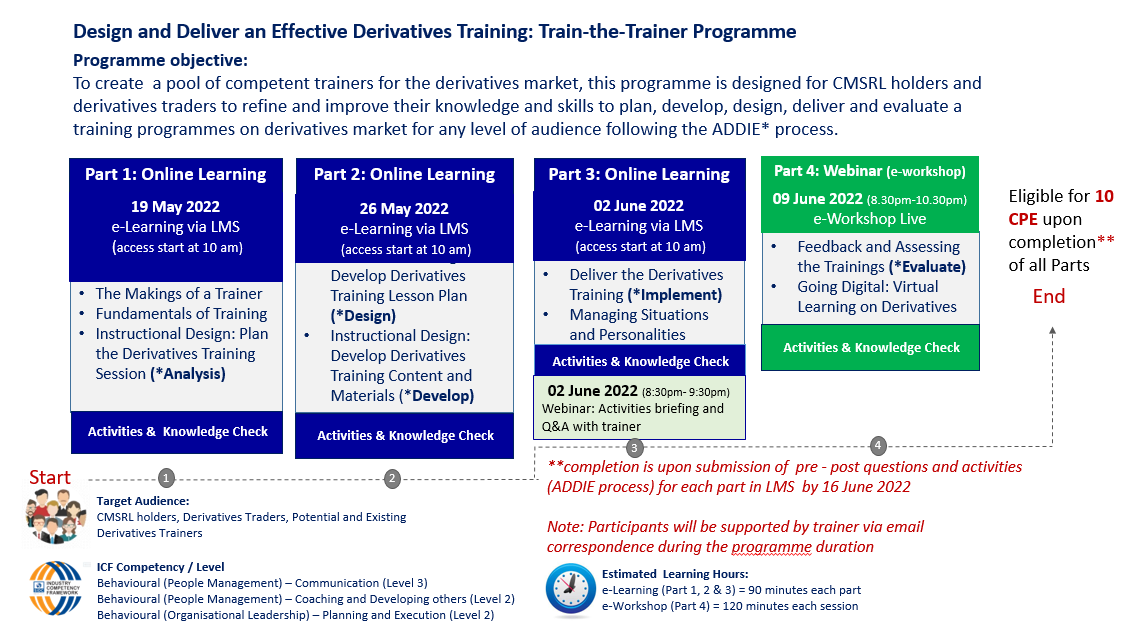

Imparting knowledge during a training session needs one to acquire the right instructional design knowledge (Analysis, Design, Development, Implementation and Evaluation) and the interpersonal skills of a trainer. This ensures the trainer-to-be is competent to deliver training programmes effectively and at the optimum standard on the topic of derivatives market.

Through this workshop, one will learn about the pedagogy for adult learner which includes planning, developing, designing, delivering and evaluating the training programmes on derivatives market for any level of audience. This includes hands-on tips and tricks that one can employ during trainings.