Learn ONLINE and fulfil your entry requirements to be registered as a Trading Representative (TR)

The Securities Industry Development Corporation (SIDC) is pleased to announce the revised standalone structure as approved by Securities Commission Malaysia for the Familiarisation Programme for Trading Representatives (FPTR). This programme is designed as a learning tutorial covering the knowledge and skills relevant for Trading Representatives (TRs) pursuant to the Licensing Handbook to carry out their duties competently and in compliance with prevailing laws and regulations.

New revised structure now available which consists of learning and revision programmes through online delivery!

With the revised structure, candidates will have the flexibility to learn at their own pace as well as have more learning avenues and learning time (maximum of 2 months access to the eFPTR) before attempting the assessment.

eFAMILIARISATION PROGRAMME FOR TRADING REPRESENTATIVES I (eFPTR I)

HRD Corp Registered Course/Programme No.: 10001138666

eFAMILIARISATION PROGRAMME FOR TRADING REPRESENTATIVES II (eFPTR II)

HRD Corp Registered Course/Programme No.: 10001138809

The listed price is intended for Malaysian participants only. If you are a non-Malaysian, we kindly request you to reach out to us at sales@sidc.com.my for further information.

SCHEDULE & PROGRAMME OUTLINE

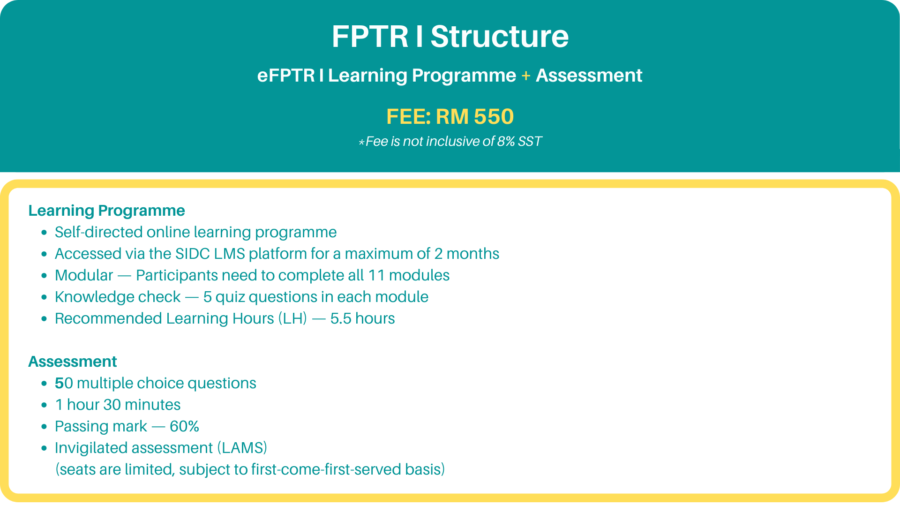

FPTR I

eFPTR I Learning Programme + Assessment

The eFPTR1 is a self-directed online learning programme offered via the SIDC Learning Management System (SIDC eLearn) platform comprising of 11 modules. It is designed as a learning tutorial covering the knowledge and skills relevant for Trading Representative (TRs) (as defined in the Licensing Handbook) to carry out their duties competently and in compliance with prevailing laws and regulations. The broad spectrum of e-learning tutorials will provide a comprehensive understanding of the Malaysian securities market for Trading Representatives (TRs) working with Participating Organisations (POs) to carry out their duties effectively and in compliance with the law.

Upon completion of this learning programme in accordance to the recommended learning hours set out below, participants will be better prepared to undertake the FPTR1 Assessment.

Learning Outcomes

Upon completing the programme, the participant should be able to:

|

|

Recommended Learning Hours

5.5 hours to complete all 11 modules (including the knowledge-check)

Competencies

|

FOR01 Anti-Money Laundering FOR02 Capital Market Institutions FOR03 Capital Market Intermediaries FOP02 Capital Market Fundamentals FOP03 Capital Market Products FUT05 Fundamental Analysis FUP16 Securities Trading FUP18 Settlement of Securities Trades |

All at proficiency level 2

Target Audience

Designed for those who intend to be to be registered as a Trading Representative (TR) pursuant to the Licensing Handbook.

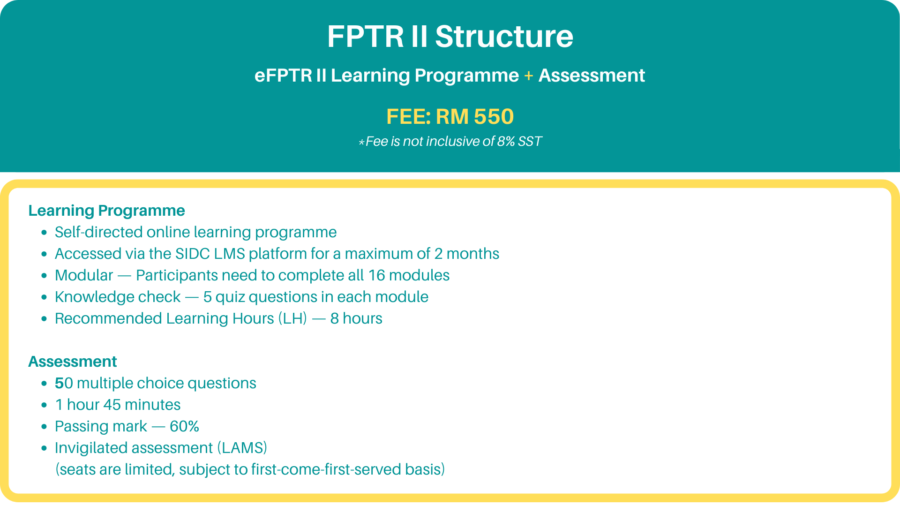

FPTR II

eFPTR II Learning Programme + Assessment

The eFPTR II is a self-directed online learning programme offered via the SIDC Learning Management System (SIDC eLearn) platform comprising of 16 modules. It is designed as a learning tutorial covering the knowledge and skills relevant to individuals who have passed the FPTR 1 (or previous FPRR1) assessment and intend to apply for a Capital Market Services Representative’s Licence (CMSRL) to carry on the regulated activity of dealing in securities.

Upon completion of this learning programme in accordance to the recommended learning hours set out below, participants will be better prepared to undertake the FPTR2 Assessment.

Learning Outcomes

Upon completing the programme, the participant should be able to:

|

|

Recommended Learning Hours

8 hours to complete all 16 modules (including the knowledge-check)

Competencies

|

FOR04 Capital Market Products Regulations (proficiency level 2) FOR06 Takeovers and Mergers (proficiency level 2) FOR01 Anti-Money Laundering FOR02 Capital Market Institutions FOR03 Capital Market Intermediaries FUP16 Securities Trading FUP18 Settlement of Securities Trades FOR05 Islamic Capital Market Regulations FUP14 Know Your Client FOP01 Capital Market Environment FOP02 Capital Market Fundamentals FOP03 Capital Market Products FUT05 Fundamental Analysis FUT07 Technical Analysis |

All at proficiency level 3

Target Audience

Designed for those who have passed the FPTR 1 (or previous FPRR1) assessment and intend to apply for a Capital Market Services Representative’s Licence (CMSRL) to carry on the regulated activity of dealing in securities.

MOCK UP

COMPUTER-BASED EXAMINATION MOCK-UP

This computer-based examination mock-up is intended to assist candidates in familiarising themselves with the format of the SIDC Assessment system. Candidates are encouraged to attempt the mock-up prior to their actual examinations.