FCPO Trading:

Derivatives Bite-Size E-Learning for Investors

FCPO trading allows you as an investor or trader to take on riskier investments with higher promised returns. However, inexperienced or reckless investors may get into trouble by taking on risks that are poorly quantified. How much you know about FCPO trading and the risks associated with its trading?

Discover all about FCPO contracts as well as risk and return of the FCPO trading. All these and many more will be covered in this online learning on Fundamental of Crude Palm Oil Futures (FCPO) Trading.

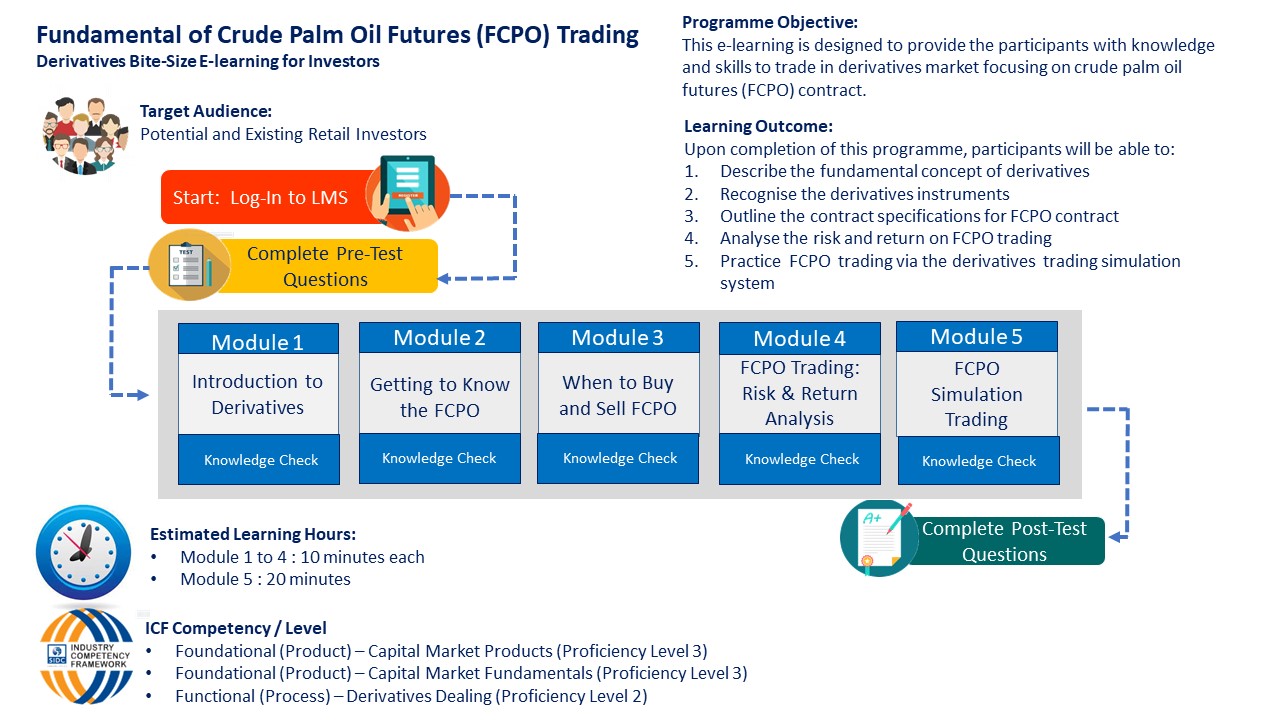

Programme Objective

This e-learning is designed to provide the participants with knowledge and skills to trade in derivatives market focusing on crude palm oil futures (FCPO) contract.

Learning Outcomes

Upon completion of this e-learning, participants will be able to:

- Describe the fundamental concept of derivatives

- Recognise the derivatives instruments

- Outline the contract specifications for FCPO contract

- Analyse the risk and return on FCPO trading

- Practice FCPO trading via the FCPO trading simulation platform

Competency Level

- Foundational (Product) – Capital Market Products (Proficiency Level 3)

- Foundational (Product) – Capital Market Fundamentals (Proficiency Level 3)

- Functional (Process) – Derivatives Dealing (Proficiency Level 2)

Learning Hours:

1 Hour which comprises of :-

- Module 1 to Module 4: 10 minutes each

- Module 5: 20 minutes

Target Audience:

- Individuals with little to no understanding on Crude Palm Oil Futures Trading

- Potential and existing derivatives traders/investors

Methodology:

E-Learning format:-

- Interactive online learning via SIDC Learning Management System (LMS)

Programme Outline

Module 1: Introduction to Derivatives

Recommended Learning Hours:

10 minutes

Overview

Introduction to derivatives is the first module of the Fundamental of Crude Palm Oil Futures (FCPO) Trading e-learning programme. The module will provide participants on the overview of the derivatives market, derivatives instruments and risk in derivatives trading.

This module consists of four topics:

- What are derivatives?

- Common types of derivatives instrument

- Use of derivatives

- Risks in derivatives trading

Objective

By the end of this module, you will be able to understand the derivatives contract, types of derivatives market, its uses and the risks involved in derivatives trading.

Module 2: Getting to Know Crude Palm Oil Futures Contracts (FCPO)

Recommended Learning Hours:

10 minutes

Overview

This module is designed to introduce the participants to the Crude Palm Oil Futures (FCPO) contract by outlining the contract specifications and some of the key terms and conditions specified in the contract such as the underlying instrument, grade and quality and expiry.

This module will cover the following topics:

- What is Crude Palm Oil Futures contract (FCPO)

- The futures contract specification

Objective

By the end of this module, you will be able to understand crude palm oil futures contract (FCPO) and outline the contract specification and its key terms and conditions.

Module 3: Trading Strategy – When to Buy and Sell the Crude Palm Oil Futures Contract (FCPO)

Recommended Learning Hours:

10 minutes

Overview

This module exposes the participants to the trading strategy of when to buy and sell the Crude Palm Oil Futures (FCPO) contract. Participants will learn the general principles when to buy and sell a futures contract through different pricing situations and scenarios. Participants will also be exposed to the generic formula for deriving the fair value of FCPO.

This module consists of the following topics:

- When to Buy and Sell a Futures Contract

- Fair Value of an FCPO

Objective

At the end of this module, participants will be able to identify when to buy and sell a futures contract as well as to calculate the fair value of a FCPO.

Module 4: FCPO Trading – Risk and Return Analysis

Recommended Learning Hours:

10 minutes

Overview

This module exposes the participants to the profit and loss of FCPO contract by recognising the risks involved in trading the FCPO. This module also distinguishes the difference between initial margin and variation margin. Participants will also be exposed to different trading scenarios of outright trading.

This module consists of the following topics:

- Profit and loss of FCPO contract

- Initial margin and variation margin

- FCPO trading scenario – Outright trading

Objective

At the end of this module, participants will be able to calculate the profit and loss of FCPO contract by recognising the risks involved, distinguish between initial and variation margin as well as understand different FCPO trading scenarios.

Module 5: Crude Palm Oil Futures Contract (FCPO) Trading Simulation

Recommended Learning Hours:

20 minutes

Overview

This module will get participants to practice trading and expand their understanding of FCPO futures by testing and applying the trading strategies using the derivative trading simulation platform. Access is free, all you need is a password to log-in. The trading simulation replicates live FCPO markets data for participants to experience the trading using real FCPO prices.

Objective

Upon completion of this module, participants will be able to practice FCPO trading by applying buy and sale strategy to profit from the simulated FCPO trading environment using the market data.