HRD Corp Registered Course/Programme No.: 10001498825

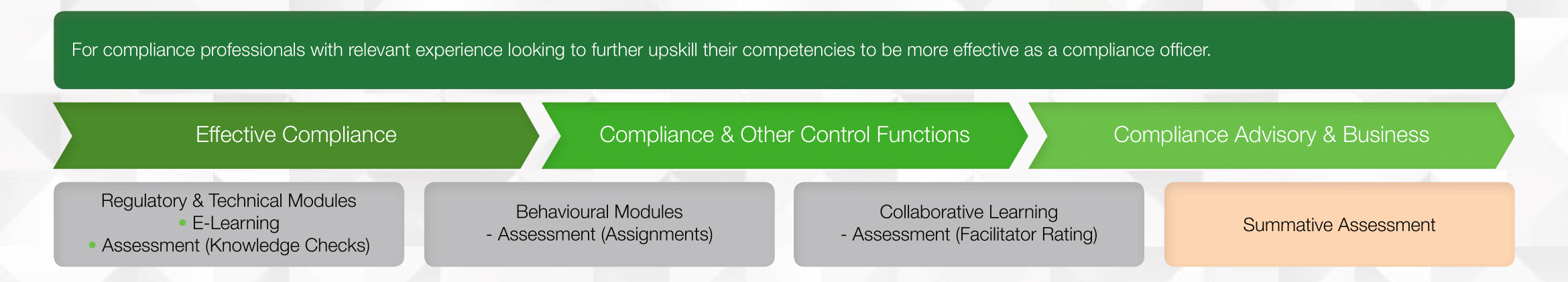

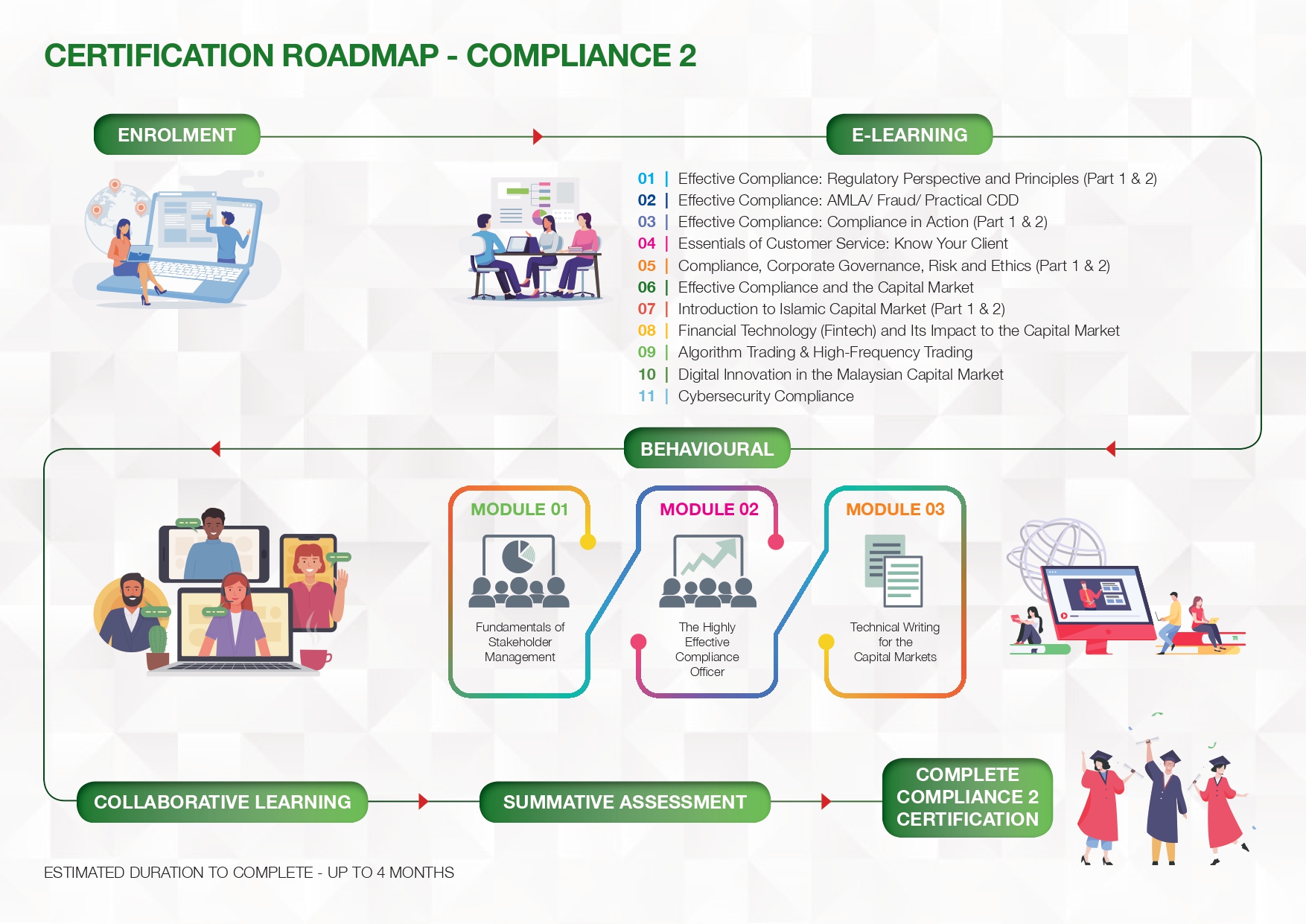

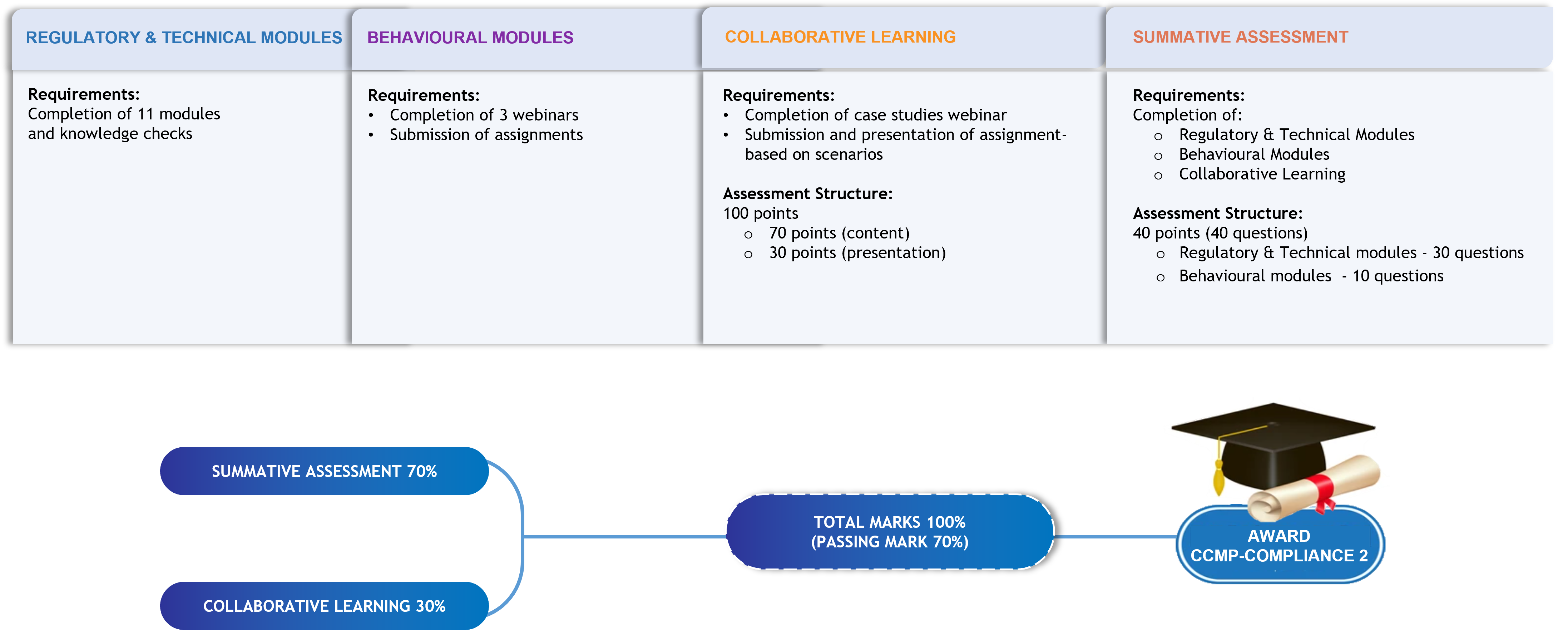

Certified Capital Market Professional (CCMP) in Compliance 2 is designed for compliance professionals with relevant experience looking to upskill their competencies further to be more effective as compliance officers.

Entry Requirements

|

Completion Requirements

|

E-Learning: Regulatory and Technical Modules 1 – 15

Programme Objective

This programme aims to strengthen and upskill the functional competencies of compliance professionals to be more effective as compliance officers.

Learning Outcomes

Upon completion of this e-learning, participants will be able to:

- Explain the capital market regulatory principles, regulatory expectations on compliance and the roles of business, compliance and internal audit in managing risks

- Discuss the AML/CFT regulatory requirements, ways to manage AML/CFT offences and the impact to business for non-compliance to AML obligations

- Explain the Shariah principles, concepts and products available in the Malaysian Islamic Capital Market

- Describe the fundamentals of FinTech, its developments, key technological drivers and cybersecurity threat threats in building a strong and vibrant FinTech ecosystem.

- Describe algorithmic and high-frequency trading (HFT), its execution and the future challenges of HFT

Recommended Learning Hours: 15 minutes

Overview

This course provides a comprehensive overview of the capital market regulatory principles which emphasises fit and proper conduct and the compliance culture as an organisational obligation. The course further provides insights on the regulatory expectations on compliance where participants will learn to balance the interests of regulators and the firm. The distinct roles of the business, compliance and internal audit in managing risk to operate effectively, the duties, responsibilities and best practices for audit and inspection. Participants will also learn of the current regulatory and compliance challenges in terms of disruptors and the digital future.

Objective

Upon completion of this programme, participants will be able to:

- Explain the regulatory requirements applicable to specific regulated activities

- Monitor compliance and identify violations in accordance with the established compliance monitoring programme

Topics

This module will cover:

- Overview of the Regulatory Environment

- Interpreting Regulation and Principles

- The Role of the Compliance Function from the Regulatory Perspective

- The Lines of Defence

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course provides a comprehensive overview of the capital market regulatory principles which emphasises fit and proper conduct and the compliance culture as an organisational obligation. The course further provides insights on the regulatory expectations on compliance where participants will learn to balance the interests of regulators and the firm. The distinct roles of the business, compliance and internal audit in managing risk to operate effectively, the duties, responsibilities and best practices for audit and inspection. Participants will also learn of the current regulatory and compliance challenges in terms of disruptors and the digital future.

Objective

Upon completion of this programme, participants will be able to:

- Identify issues arising from digital technologies and other technological advancement including related cybersecurity risks

- Review and propose actions to ensure compliance with the various regulatory requirements

Topics

This module will cover:

- Communicating with the Regulator

- Regulatory Reporting and Visits

- Regulatory and Compliance Challenges

- Corporate Liability and Other Liabilities

- Digital Technology and RegTech

- Compliance and Cybersecurity

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course provides participants with the strategies and tools to detect and prevent the increasingly complex money laundering, fraud and terrorism activities undertaken by the perpetrators while taking into account the risk profile, regulatory obligations and the legal framework. This course covers contemporary issues on AML, fraud and terrorism financing including the latest regulatory approaches and insights on how the compliance could support the organisations to combat money laundering through the use of new risk management strategies and the use of the latest technology.

Objective

Upon completion of this programme, participants will be able to:

- Identify the latest cyber threats and risks trends amidst the changing business landscape

- Discuss the AML/CFT regulatory requirements and enforcement for the Financial Institutes (FIs) and businesses

- Explain the measures taken to manage AML/CFT offences

- Analyse the impact of non-compliance to AML obligations and how it affects the businesses

Topics

This module will cover:

- Current Trends and Updates in Money Laundering, Fraud and Terrorism Financing

- Regulatory Updates and Approaches

- AML – An Operational Perspective (Front, Middle and Back Office)

- The Risk Based Approach to Money Laundering

- Practical CDD

- Best Practices: What Can Be Learned and Challenges

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course provides participants with the requisite knowledge and skills to effectively apply the compliance principles and concepts and carry out the core functions, primarily focusing on integrated risk management, CDD, monitoring and assessment to the advisory functions and the development of a compliance programme that includes focusing on the culture of compliance.

Objective

Upon completion of this programme, participants will be able to:

- Identify and assess strategic and operational risks associated with the conduct of licensed intermediaries

- Explain the importance of risk oversight, ethical and compliance programmes and the consequences of failures in such programmes

Topics

This module will cover:

- Compliance in Action

- Integrated Risk Management

- Conduct Risk – Market Conduct

- Client On boarding/CDD and the Risk Based Approach

- Managing Effective Compliance Conversations

- Dealing with Difficult Characters with the Front Office

- Compliance Monitoring and Measuring (Conduct Risk)

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course provides participants with the requisite knowledge and skills to effectively apply the compliance principles and concepts and carry out the core functions, primarily focusing on integrated risk management, CDD, monitoring and assessment to the advisory functions and the development of a compliance programme that includes focusing on the culture of compliance.

Objective

Upon completion of this programme, participants will be able to:

- Identify and assess strategic and operational risks associated with the conduct of licensed intermediaries

- Explain the importance of risk oversight, ethical and compliance programmes and the consequences of failures in such programmes

Topics

This module will cover:

- Compliance in Action

- Integrated Risk Management

- Conduct Risk – Market Conduct

- Client On boarding/CDD and the Risk Based Approach

- Managing Effective Compliance Conversations

- Dealing with Difficult Characters with the Front Office

- Compliance Monitoring and Measuring (Conduct Risk)

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course provides participants with the requisite knowledge and skills to effectively apply the compliance principles and concepts and carry out the core functions, primarily focusing on integrated risk management, CDD, monitoring and assessment to the advisory functions and the development of a compliance programme that includes focusing on the culture of compliance.

Objective

Upon completion of this programme, participants will be able to:

- Determine reporting procedures in dealing with issues of risk oversight and compliance

- Discuss building and effective control framework and instilling the compliance culture in the organisation

Topics

This module will cover:

- Effective Report Writing for Compliance

- Building an Effective Control Framework

- Balancing Compliance Role and Business Needs

- Compliance and Advisory – Facilitating Innovation

- Compliance Stakeholder Relations

- Compliance Programme to Compliance Culture

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course will provide participants with the knowledge and skills to continuously improve quality of customer focus service levels and solutions, sales & marketing and know-your client.

Objective

Upon completion of this programme, participants will be able to:

- Analyse information to establish trends in customer needs and expectations

- Anticipate customers’ needs and provide solutions based on Customer Focused Service Strategies

- Determine Customer Service Strategies to the Risk Based Approach to KYC/CDD Practical CDD

Topics

This module will cover:

- Market Intelligence

- Customer Focused Services

- Develop Customer Focused Service Strategies

- Current developments ‘what is coming’

- Effective Consultative Skills – Improvements to customer focused services

- Align Customer Service Strategies to the Risk Based Approach to KYC/CDD Practical CDD

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course will provide participants with the knowledge and skills in carrying out their duties as a capital market professional in relation to corporate governance practices, risk management in the context of compliance and ethical practices.

Objective

Upon completion of this programme, participants will be able to:

- Describe the organisational operational requirements of the recommended corporate governance practices

- Explain roles and responsibilities consistent with the recommended corporate governance practices

Topics

This module will cover:

- Corporate Governance Principles and Practices

- Relationship between Compliance, Internal Audit and Risk

- Risk Identification and Assessment (capital market activities/business)

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course will provide participants with the knowledge and skills in carrying out their duties as a capital market professional in relation to corporate governance practices, risk management in the context of compliance and ethical practices.

Objective

Upon completion of this programme, participants will be able to:

- Outline the risk management programme in capital market activities and the desired risk tolerance/appetite across the industry

- Explain the appropriate reactions in given situations (or in a case) consistent with the industry code of conduct

Topics

This module will cover:

- Risk Control and Monitoring (capital market activities/business)

- Principles and Code of Conduct

- Fairness and Transparency

- Conflict of interest

- Confidential and sensitive information

- Dynamics of CG, Risk and Ethics from a Compliance Perspective

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course provides understanding and application on the concepts of strategy, finance, marketing and operations in the capital market and aligns these with changes occurring in business, social-political, environment and technology; to build successful sustainability-driven ventures that creates value for multiple stakeholders in the capital market particularly from the compliance standpoint.

Objective

Upon completion of this programme, participants will be able to:

- Describe the current technological development as well as disruptors in the capital market fraternity particularly for Dealing in Securities, Dealing in Derivatives and Fund Management

- Formulate sustainable business strategies in line with the capital market regulator’s expectation

- Anticipate the changes of political, economic and social landscape and that might impact businesses

- Appraise the need of firms to embed SRI agenda in their business processes

- Assess the impact of technological revolution towards business processes and profitability

Topics

This module will cover:

- Developments and Disruptors in the Capital Market Landscape

- Strategy for Capital Market Products and Services Development

- Compliance and Business Challenges

- Dealing in Securities

- Dealing in Derivatives

- Fund Management

- SRI and Compliance

- Business Strategy and Sustainability

- Business Case for Sustainability

- Business Sustainability and Digital Technological Revolution

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course focuses on Islamic Capital Market (ICM) principles and concepts and products available in the Malaysian market from Shariah compliant equities to Islamic Structured products. Particular emphasis is given to the case of the Malaysian market, although some international context is mentioned, for added knowledge. Specific examples, illustrations, facts and statistics are given, so participants are informed on the current state of the art.

Objective

Upon completion of this programme, participants will be able to:

- Explain the type of contracts in Islamic capital market

- Distinguish between Islamic and conventional capital market products and instruments

- Describe the structures, features, Shariah and regulatory requirements as well as issues relating to trading of Islamic capital market products and instruments

Topics

This module will cover:

- Introduction to Islamic Capital Markets (ICM)

- Shariah-compliant Equities

Competencies

|

|

Recommended Learning Hours: 15 minutes

Overview

This course focuses on Islamic Capital Market (ICM) principles and concepts and products available in the Malaysian market from Shariah compliant equities to Islamic Structured products. Particular emphasis is given to the case of the Malaysian market, although some international context is mentioned, for added knowledge. Specific examples, illustrations, facts and statistics are given, so participants are informed on the current state of the art.

Objective

Upon completion of this programme, participants will be able to:

- Outline the key principles in Sukuk structuring and issuance

- Describe the types of Sukuk and its distinguished features as compared to a conventional bond

- Distinguish between Islamic and conventional equity products and instruments

- Describe the structures, features, Shariah and regulatory requirements as well as issues relating to trading of Islamic equity products and instruments

- Evaluate the Islamic equity instruments as an alternative means of financing and investments

- Compare the performance of conventional and Islamic capital market product

Topics

This module will cover:

- Sukuk

- Other Markets within ICM

- Comparison with conventional markets and related issues

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course provides an introduction to FinTech developments, the link to RegTech and SupTech and how it promotes a conducive capital market landscape through the development of a holistic FinTech ecosystem. It will also focus on the fundamentals of FinTech, key technological drivers, and cybersecurity threats in building a strong and vibrant FinTech ecosystem.

Objective

Upon completion of this programme, participants will be able to:

- Identify the drivers of innovation and success of fintech industry

- Explain the importance of innovative technology (Regtech and SupTech) in enhancing regulatory oversight

- Analyse the significance of technology-driven innovations in financial services, and to discuss capital market future landscape

Topics

This module will cover:

- Introduction to FinTech

- FinTech and its Impact on Traditional Markets – Local and Global Developments

- The Market Drivers of FinTech

- RegTech and SupTech: What they mean for Financial Supervision

- Cybersecurity in FinTech: Key Role of Data and Security in Data-Driven Finance

- Technology-Driven Innovations in Capital Market Services: Analysis and Evaluation

- Capital Market Landscape: Future Technology and Its Impacts

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course provides an introduction to algorithmic and high-frequency trading (HFT), how HFT is executed and the future challenges of trading while maintaining resilience.

Objective

Upon completion of this programme, participants will be able to:

- Recognise High-Frequency Trading and its evolution

- Examine the importance of regulatory oversight in ensuring fair and orderly trading market

- Discuss the significance of algorithmic & HFT trading on capital markets

Topics

This module will cover:

- Algorithmic & High-Frequency Trading (HFT)

- Dark Pool – Alternative Trading System (ATS)

- The Algorithm Trading Platforms, Technologies and Strategies

- Regulatory Oversight

- Governance, Risk and Compliance Issues

- Issues and Challenges

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course provides insights on the digital initiatives spearheaded by the Securities Commission Malaysia which include the various frameworks for Digital Investment Management (DIM), alternative funding platforms, the Digital Asset Exchanges (DAX), the Initial Exchange Offerings (IEO) and the Digital Asset Custodians (DAC). Discussions at this programme will also include the impact the initiatives bring to the capital market value chain and how one should flexibly adapt and respond to the changes in doing business differently.

Objective

Upon completion of this programme, participants will be able to:

- Explain the impact of technology on the capital market industry

- Discuss new products and services which has an impact on compliance processes

- Analyse the impact of technology and recommend changes to business processes

Topics

This module will cover:

- Digital Agenda for the Malaysian Capital Market

- Digital Investment Management (DIM) in Malaysia

- Introduction to Cryptocurrencies and Digital Asset Exchanges (DAX)

- Initial Exchange Offerings (IEO) and Digital Asset Custodians (DAC) Framework

- Introduction to Alternative Funding Platforms

- Equity Crowd Funding (ECF) and Peer to Peer Financing (P2P) Explained

Competencies

|

|

Recommended Learning Hours: 30 minutes

Overview

This course provides overview and the context when it comes to cybersecurity compliance as the entity cannot afford to overlook data breaches, security vulnerabilities and other threats as skilled hacker tend to exploit the human factor through successful phishing scams and other type of cyber-attacks. The keyword is awareness as it is understood that the weakest link and cause of breach is due to the human factor. This session will also look into system capabilities and control measures, whilst emphasizing the context of regular testing to ensure effective information security and control environment.

Objective

Upon completion of this programme, participants will be able to:

- Identify the key fundamentals that resulted in cybersecurity risks.

- Explain the importance on the compliance measures in avoiding violation of data security measures.

- Analyse the learnings from previous incidents and implement more effective controls in managing cybersecurity risks.

Topics

This module will cover:

- Cyber Attack: The Then, the Now & the Future.

- Cyber Security

- The Future of Cyber Security

- Case Study: Equifax and JP Morgan

- Cybersecurity for the capital market and its regulated activities

- Data governance, privacy & protection

- Cyber incident response plan in safeguarding company’s assets.

- Reporting Obligation for Market Intermediaries

Competencies

|

|

Overview

In today’s dynamic and complex regulatory/business landscape, responding to trends and risks necessitates having highly effective compliance officers equipped with the tools and resources to enhance their skills and influence. Compliance officers are integral to the pursuit of an organisation’s business objectives in supporting and empowering the business to achieve them in an ethically and compliant manner as well embedding ethics and compliance within the organisation’s culture.

Highly effective compliance officers are able to position themselves and their compliance programmes as an enabler towards successful realisation of the business objectives whilst ensuring and maintaining compliance. This requires a wide-ranging and advanced skillset that includes knowing the business, stakeholder relations, analytical and strategic thinking and engagement and communication with the regulators.

Objective

This course covers knowledge and skillsets for compliance professionals with relevant experience looking to further upskill to enhance effectiveness as a compliance officer. This includes going beyond compliance concepts and frameworks by enabling the compliance professionals to take a practical approach to real life issues encountered in discharging their functions, managing the business of the intermediaries and engagement and communication with the regulators.

Learning Outcomes

By the end of this programme, participants will be able to:

- Explain the role of a compliance officer in today’s business and regulatory landscape

- Examine the skillsets and attributes that makes a compliance officer highly effective in discharging the functions and managing the business of the intermediaries

- Discuss the elements of good judgement in dealing with issues of business challenges and regulatory expectation

- Discuss the approach on dealings, engagement, and communication with the regulators

Target Audience

Individuals

For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer

Companies

Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companies

Competencies

|

|

Programme Outline

| 8.30 am | Log in to the Webinar |

| 9.00 am | Role of Compliance Officers Today

|

| 10.00 am | Screen Break |

| 10.30 am | The Making of a Highly Effective Compliance Officer

|

| 12.30 pm | Screen Break |

|

2.00 pm |

The Making of a Highly Effective Compliance Officer (cont)

|

| 3.15 pm | Screen Break |

| 3.30 pm | Engagement and Communication with the Regulators

|

| 5.00 pm | End of Programme |

Overview

This course primarily provides participants with the techniques to prepare different types of documentation for different purposes according to capital market activities in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting. Quality technical writing for compliance purposes requires a deep understanding of how the capital market works, how regulations are administered and updated, how normal business practice are done by the capital market players, and ideas of how compliance are bypassed by perpetrators. This helps to uphold a high standard of capital market compliance, to continue best practices in order to reduce the possibilities of non-compliance. Compliance officers need the ability to interpret the regulation, ability to do their own research, more proactiveness on compliance sensitivity, communication with clear information, and avoid any misleading info.

Objective

Participants will be able to prepare different types of documents intended for capital market stakeholders in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting.

Learning Outcomes

By the end of this programme, participants will be able to:

- Collate required information to be included in the compliance documents to meet specific objectives

- Prepare different types of related documents in compliance with industry standards and regulations

- Organise information in written formats using language that can be understood by intended readers

- Examine best practices for technical reports towards improvement of organisational and regulatory reporting

Target Audience

Individuals

For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer

Companies

Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companies

Competencies

|

|

Programme Outline

| Registration | |

| 9.00 am | Regulatory Requirements

|

| 10.30 am | Screen Break |

| 10.45 am

|

Skills for Technical Writing

|

| 1.00 pm | Lunch |

| 2.00 pm

|

Skills for Technical Writing (2)

|

| 3.30 pm | Screen Break |

| 3.45 pm

|

Best Practices to Uphold

|

| 5.00 pm | End of Programme |

Overview

The role of compliance necessitates an awareness of market and business challenges along with associated opportunities that can be derived successfully by engaging with a multitude of stakeholders. This will allow the merging of regulatory expectations, industry knowledge, experience and the needs of stakeholders to effectively execute the compliance function in the organisation.

In this course participants will learn how to identify stakeholders, perform stakeholder analysis, and analyse communications plans and organisational requirements. Participants will also learn different methods of stakeholder engagement and when to utilise them to perform the compliance role effectively. One of the perennial issues for the compliance team is balancing their role between board reporting and communications with senior management. This is in addition to communicating horizontally across the organisation, namely keeping communication channels open to drive and foster a compliance-savvy organisation.

Objective

This programme will enable compliance professionals to utilise appropriate strategies, influencing and persuasive techniques and communication tools for stakeholder management in managing compliance matters based on their organisations’ strategies and overall objectives.

Learning Outcomes

By the end of this programme, participants will be able to:

- Describe the fundamental components of stakeholder management and its importance to the compliance function

- Identify strategies to gain cooperation and support from various stakeholders to meet compliance requirements

- Discuss the importance of maintaining continuous communication with stakeholders in dealing with compliance issues

- Develop a plan on building relationships and networking in the field of compliance

- Determine the success factors of stakeholder engagement to the compliance role

Target Audience

Individuals

For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer

Companies

Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companies

Competencies

|

|

Programme Outline

| Registration | |

| 9.00 am

|

Stakeholder Identification and Analysis for the Compliance Function

|

| 10.30 am | Screen Break |

| 10.45 am

|

Essential Communications Techniques with Stakeholders

|

| 1.00 pm | Lunch |

| 2.00 pm

|

Fostering Positive Dialogue with Regulators and Key Stakeholders

|

| 3.30 pm | Screen Break |

| 3.45 pm

|

Monitoring the Success of Stakeholder Engagements

|

| 5.00 pm | End of Programme |

Case Study Series & Communities of Practice (Real Life Scenarios)

Programme Overview

CCMP-C2, Essentials of Compliance: Case Study Series & Communities of Practice (Real Life Scenarios) will feature real-life case studies and scenarios to discuss and explore the core compliance issues and their implications faced by businesses today. Through discussions participants will deliberate on the approaches taken when faced with similar situations, the rationale behind the decision made, consider on the best compliance practices, as well as learn from others within the industry.

Programme Objective

This programme is designed to give insights and equip participants in the capital market with an in-depth understanding and approaches in dealing with compliance issues through real-life case studies and scenarios ranging from essential compliance concepts, functions, approaches, tools and skillsets on capital market laws, principles and regulatory requirements, technical areas, and general activities of intermediaries.

Learning Outcomes

Upon completion of this programme, participants will be able to:

- Identify the core compliance issues faced in the capital market industry, its implications and the approaches that can be taken to mitigate them

- Explain the importance of compliance and the regulatory requirements applicable to specific regulated activities in the capital market

- Discuss the roles and responsibilities of the compliance function and factors to consider in creating good compliance practices within an organisation and capital market industry

- Develop critical thinking, problem solving, and communications skills needed by compliance professionals in handling compliance issues and stakeholders involved

Recommended Learning Hours: 180 minutes (60 minutes for each case)

Overview

The 3 cases studies briefly explain the facts in relation compliance issues faced by compliance officers today. Analyse and discuss each situation and its practical in approaching a regulatory breach from a compliance perspective.

Objective

Upon completion of this programme, participants will be able to:

- Gain a better understanding of governance, risk, compliance and ethics

- Relate the fundamental reasons for compliance to capital markets

- Show the costs of, and the benefits brought by, compliance

- Gain a better understanding of the role and objectives of compliance

- Demonstrate how compliance meets these objectives

- Show how compliance provides assurance, both internally and externally

- Develop knowledge of the thinking and communications skills needed by compliance professionals

- Identify areas where communications are required

- Escalation and reporting requirements

- How to handle breaches, who to involve, and external requirements

Case

This programme will cover:

- Effective Compliance: Regulatory Perspective and Principles

- Digital Technology and RegTech

- Advisory and Technical Writing

Competencies

|

|

Recommended Learning Hours: 120 minutes (3 scenarios per group, presentation of 10 mins per group)

Overview

This programme primarily gives an overview on the compliance concepts and issues from real life scenarios perspective and the practical approaches that a compliance officer can take in managing them effectively.

Objective

Upon completion of this programme, participants will be able to:

- Describe the anti-bribery and corruption requirements of reporting institutions in capital market

- Examine the importance in providing proper client advisory based on customer suitability

- Identifying red flags of a specific example of money laundering

- Discuss on the need of having effective policies to manage potential conflict of interest to safeguard sensitive information

- Recognise the importance of information security reporting requirements and the implications of not reporting breaches to the regulators and exchange on a timely basis

- Describe fair dealing with customers in accordance with the Code of Ethics and Code of Conduct for Capital Markets

- Identifying ransomware red flags as part of cybersecurity awareness

- Recognise the application of a data governance policy and the implications it will have on the organisation.

- Indicate the implications of not performing and reporting reviews on a timely basis

- Explain the concept of 3 lines of defence and the roles of, and expectations of, a compliance and the role of compliance

- Infer the AML/CFT requirements and how they tie to sanctions additional challenges posed by digital onboarding

- Recognise the role of the compliance function, the issues faced by it and how it can add value to an organisation

- Deliberate the different factors, we need to consider in relation to data management

Scenarios

This programme will cover:

- Effective Compliance: Regulatory Perspective and Principles

- Digital Technology and RegTech

- Effective Compliance: AMLA/Fraud/Practical CDD

- Effective Compliance: Compliance in Action

- Dealing with Non-compliance

- Monitoring/ Reporting of Intermediary’s Business

- Advisory – Create, promote and cultivate a compliance culture and standards

- Effective Report Writing

- Essentials of Customer Service: Know Your Client

- Client – Review client account opening documentation

- Client – KYC procedures and client account dealing

- Segregation of Duties

- Effective Compliance and the Capital Market

- Financial Technology (Fintech) and Its Impact to the Capital Market

- Education and Training – Ensure adequate training

Competencies

|

|

The CCMP in Compliance 2’s E-Learning and Webinars are available as standalone packages. They each consist of all the learning modules and webinars of the respective category.

| PROGRAMME NAME | REGISTRATION END DATE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|

| Effective Compliance (formerly known as CCMP in C2) E-Learning Package | All Year Long | 650.00 | Register Here |

Register for the complete CCMP in Compliance 2 programme to earn the CCMP certification.

| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – C2 (Intake 4/2025) |

30 July 2025 |

24 Sept 2025:

|

View Here | 4,800 | Register Here |

|

24 Sept 2025:

|

Register Here | ||||

| CCMP – C2 (Intake 5/2025) |

25 Sept 2025 |

26 Nov 2025:

|

View Here | 4,800 | Register Here |

|

26 Nov 2025:

|

Register Here |

*The SIDC reserves the right to amend the programme as deemed appropriate without prior notice

The CCMP in Compliance 2’s E-Learning and Webinars are available as standalone packages. They each consist of all the learning modules and webinars of the respective category.

| PROGRAMME NAME | REGISTRATION END DATE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|

| Effective Compliance (formerly known as CCMP in C2) E-Learning Package | All Year Long | 650.00 | Register Here |

Register for the complete CCMP in Compliance 2 programme to earn the CCMP certification.

| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – C2 (Intake 4/2025) |

30 July 2025 |

24 Sept 2025:

|

View Here | 4,800 | Register Here |

|

24 Sept 2025:

|

Register Here | ||||

| CCMP – C2 (Intake 5/2025) |

25 Sept 2025 |

26 Nov 2025:

|

View Here | 4,800 | Register Here |

|

26 Nov 2025:

|

Register Here |