HRD Corp Registered Course/Programme No.: 10001402870

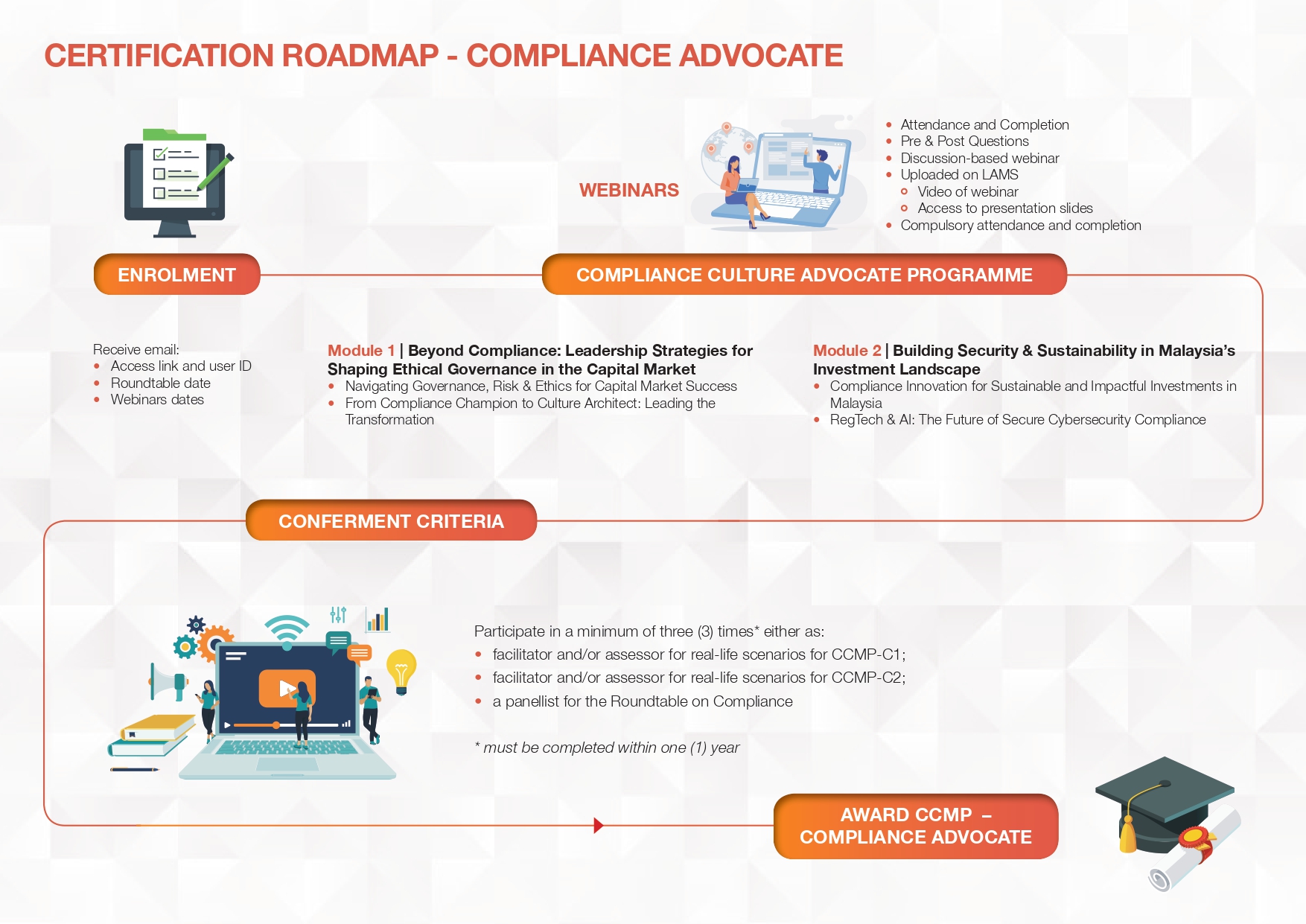

Certified Capital Market Professional (CCMP) as Compliance Advocate is for experienced compliance professionals to lead, mentor, and network with compliance communities of practice, and discuss compliance issues, scenarios, formulate strategies, and solutions which balance business needs with regulatory requirements and expectations.

Entry Requirements

|

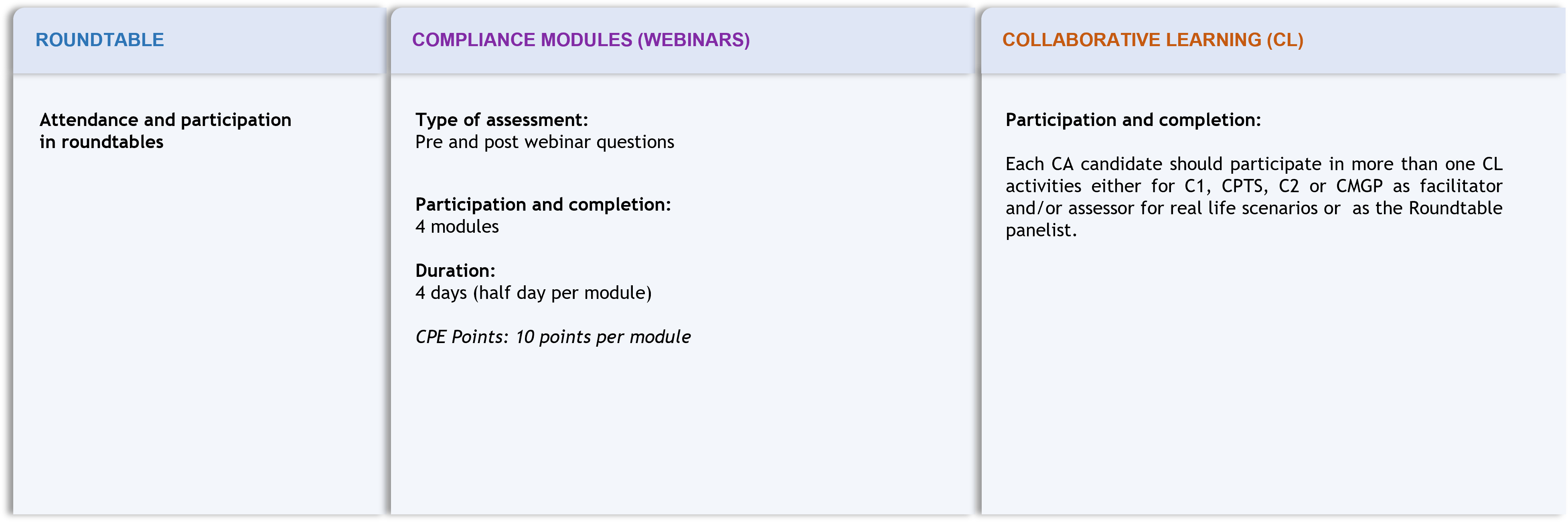

Completion Requirements

|

Programme Overview

The Malaysian capital market is undergoing a period of significant transformation. Emerging technologies, evolving regulations, and rising cybersecurity threats require compliance officers to be more than just rule-followers. They need to be strategic leaders, capable of driving cultural change, embracing innovation, and promoting sustainable business practices.

Programme Objective

This programme will equip senior compliance officers with the knowledge and skills necessary to thrive in this dynamic environment.

Learning Outcomes

By the end of this programme, participants will be able to:

- Discuss the impact of global and local regulatory and business environment on the compliance function

- Develop strategies for compliance management and dealing with non-compliance

- Determine key principles, framework and practices of good governance and its importance

- Explain the role and responsibilities of directors and management in risk management and oversight

- Assess the current compliance programme and identify areas for cultural shift and improvement

- Design and implement effective strategies for integrating compliance into the organization

- Evaluate resources and tools to support the continuous journey towards a robust compliance culture

- Discuss new approaches and best practices for future compliance framework in meeting emerging trends, business needs and market demands to ensure business sustainability

- Evaluate the potential trade-offs and synergies between integrating ESG factors into investment strategies and achieving competitive returns

- Analyse the evolving cybersecurity landscape in the Malaysian capital market and the challenges it presents

- Discuss key RegTech and AI solutions for automating tasks, identifying threats and strengthening your cyber defences

- Evaluate the impact and ROI of RegTech and AI investments on cybersecurity posture

Capital Market Roundtable on Compliance

More Info Coming Soon

PROGRAMME FEE AND REGISTRATION

Before registering, please go through the programme Handbook and Terms and Conditions that are accessible via this page’s Download section

Register for the complete CCMP as Compliance Advocate programme to earn the CCMP certification.

| Programme Name | Date | Link |

| CCMP as Compliance Advocate | Stay tuned for upcoming dates | No Link |