HRD Corp Registered Course/Programme No.: 10001575701

CCMP-SRI2 builds on the foundational understanding from CCMP-SRI1, advancing participants’ ability to apply practical sustainability frameworks, align with regulatory and global standards, and structure complex SRI products. The programme also explores innovations in carbon markets and the integration of Maqasid Shariah within Islamic capital markets, equipping participants with the tools to lead in this growing space.

Entry Requirements

|

Completion RequirementsCompletion of the programme is upon fulfillment of all requirements below:

|

Programme Overview

Financial institutions are increasingly prioritising the alignment of their portfolios with sustainability goals in response to growing societal expectations and the rising demand for investments that generate both financial returns and positive environmental or social impact. This shift is largely driven by heightened awareness of climate change, social inequalities, and governance issues, as well as increasing pressure from investors, regulators, and stakeholders who expect businesses to integrate sustainable and responsible practices into their operations. At the same time, these institutions must navigate a rapidly evolving landscape of regulations, industry standards, and best practices to ensure full compliance and mitigate risks.

The CCMP-SRI2 programme prepares participants to develop innovative solutions that align with the evolving demands of sustainable and responsible investment. It focuses on the practical application of the fundamentals of sustainability, ESG, and sustainable and responsible investment (SRI) to address the challenges of this dynamic market. The programme covers key areas such as developing ESG assessment frameworks, diversifying investment portfolios with ESG-focused assets, structuring sustainable bonds and alternative investments, integrating carbon markets, and understanding the role of sustainability within Islamic capital markets.

Programme Objective

The programme equips participants with the skills to apply procedures and methodologies to structure complex SRI products, advise on ESG strategies and sustainability innovation such as carbon markets, alignment with regulatory requirements, standards taxonomies and best practices. This programme will also focus on the harmonisation of ESG, sustainability within Islamic capital markets.

Learning Outcomes

By the end of the programme, participants will be able to:

- Establish procedures and methodologies for structuring complex and alternative SRI products aligned to regulatory requirements, established and international standards, taxonomies and best practices

- Advise on sustainability innovation and ESG strategies that ensure alignment to regulatory requirements, established and international standards, taxonomies and best practices

- Develop comprehensive ESG assessment frameworks that integrate industry standards, regulatory requirements, and best practices to effectively evaluate environmental, social, and governance performance.

- Assess the harmonization of ESG and sustainability principles within Islamic capital markets to promote integrated and sustainable investment solutions aligned with Maqasid Al-Shariah

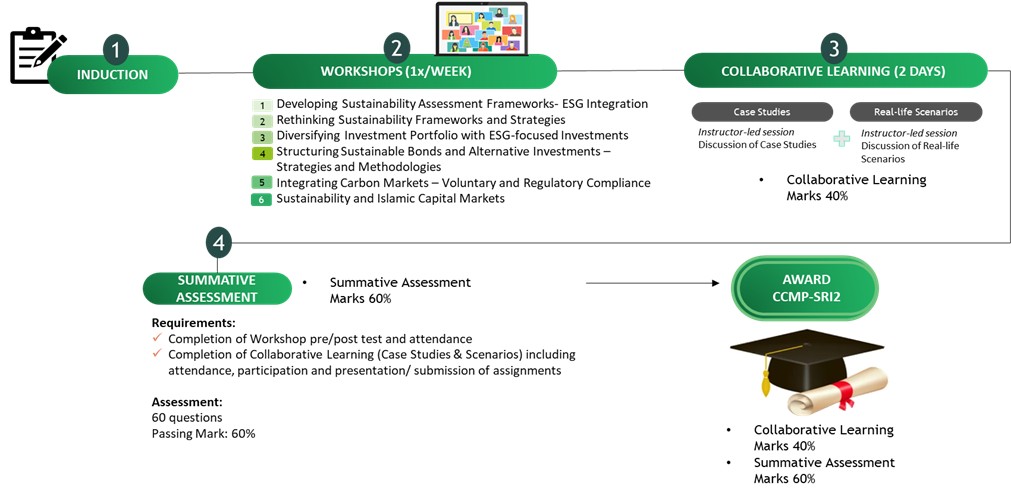

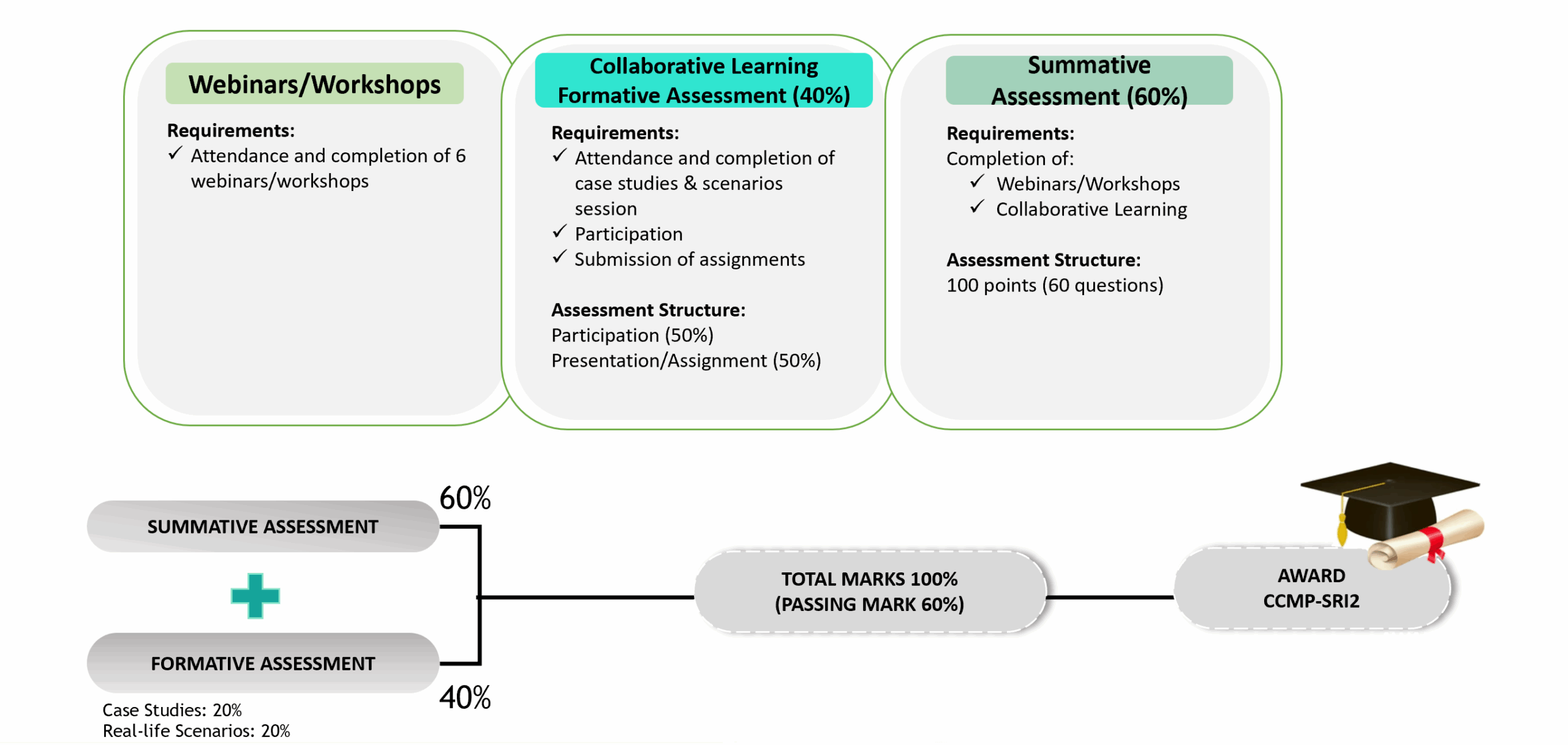

Certified Capital Market Professional in Sustainable and Responsible Investment 2 CCMP-SRI2) is conducted via blended mode and comprises the following components:

- Workshops

- Collaborative Learning

- Assessment

|

|

- Certified Capital Market Professional in Sustainable and Responsible Investment 1 (CCMP-SRI1) holder.*Exemption for Entry Requirements will be based on case-to-case basis

The total duration for CCMP-SRI2 programme is approximately 12 weeks (3 months).

- Workshops (6 workshops) = 1-day workshop per week

- Collaborative Learning = 2 days

- Summative Assessment = 1.5 hours

Sustainability analysts, heads of research, corporate finance professionals, investment product structurers with hands-on SRI experience, as well as senior fund managers, and other seasoned practitioners in the capital markets and financial services industry who are actively involved in assessing, structuring and integrating SRI strategies, and professionals within companies who must understand how to raise sustainable funds to align corporate strategies and financial structures with evolving sustainability standards and investor expectations.

Completion of the programme is upon fulfilment of all requirements below:

- Completion of workshops

- Completion of collaborative learning

- Passing the formative and summative assessments

Workshop Programme Outline

OVERVIEW

Amid of interconnected global challenges, organizations are prioritizing sustainability, driven by investor demand for sustainable and responsible investments (SRI) grounded in Environmental, Social, and Governance (ESG) factors. This necessitates the adoption of robust sustainable assessment frameworks and precise materiality assessments to develop strategies that advance environmental stewardship and social equity. The growth of carbon markets provides a vital tool for organizations to manage their environmental impact. Integrating of Maqasid al-Shariah principles offers a strong ethical guide, fostering a comprehensive approach to sustainability that champions justice, equality, and the welfare of current and future generations.

OBJECTIVE

The workshops are designed to equip participants with application of the relevant assessment framework, materiality concept, SRI strategies, and financial instruments in investment decision-making and structuring SRI products.

LEARNING OUTCOMES

By the end of workshops, participants will be able to:

- Develop a sustainable assessment framework to support informed investment decision-making.

- Apply the concept of materiality, encompassing both financial and impact materiality in investment analysis.

- Implement SRI strategies effectively to diversify investment portfolios

- Apply appropriate frameworks and taxonomies in the assessment and structuring of sustainable bonds and alternative investments.

- Integrate carbon market instruments from both voluntary and regulatory compliance markets into SRI strategies.

- Integrate Maqasid al-Shariah principles into strategic decision-making within Islamic capital markets.

| Workshop 1: Developing Sustainability Assessment Frameworks | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop introduces key components of a sustainability assessment framework that support decision-making across the investment value chain. THis includes tailoring sustainable and responsible investment (SRI) strategies and considerations across different asset classes. |

| Objective | This workshop aims to equip participants with the ability to apply a sustainability assessment framework for investment decision-making, tailoring SRI strategies across different asset classes while ensuring alignment with regulatory requirement, through the investment value chain. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | Key ESG Trends

|

| 9.45 am | Key Components of a Sustainability Assessment Framework

|

| 10.45 am | Morning Tea Break |

| 11.00 am | Group Activity and Discussion:

|

| 11.45 am | Foundational Areas to Enable SRI Implementation:

|

| 12.15 pm | Driving the SRI Mandate:

|

| 1.00 pm | Lunch Break |

| 2.00 pm | Deep Dive into SRI Methodology:

|

| 3.30 pm | Afternoon Tea Break |

| 3.45 pm | Group Activity:

|

| 4.45 pm | Debrief and Wrap Up:

|

| 5.00 pm | End of Programme |

| Workshop 2: Rethinking Sustainability Frameworks and Strategies | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop will dive deeper into the concept of materiality, focusing on double materiality, which covers both financial and impact materiality, and it’s integrated into sustainability assessment frameworks. It explores sectoral ESG risks and opportunities and examine how investment strategies can be reshaped in response. |

| Objective | This workshop aims to upskill participants to develop an advanced understanding of materiality, including double materiality, and integrate materiality principles into sustainability assessment frameworks. It also focuses on analysing sectoral ESG risks and opportunities to embed ESG considerations into investment decision-making process. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | Materiality in Sustainability

|

| 9.45 am | Morning Tea Break |

| 10.00 am | Introduction to the Double Materiality Concept

|

| 11.00 am | Group Activity and Discussion:

|

| 12.00 pm | Lunch Break |

| 1.00 pm | Sectoral ESG Risk and Opportunities

|

| 2.15 pm | Group Activity and Discussion

|

| 3.15 pm | Afternoon Tea Break |

| 3.30 pm | Integration of Materiality into Sustainable Assessment Framework

|

| 4.50 pm | Debrief and Wrap Up

|

| 5.00 pm | End of Programme |

| Workshop 3: Diversifying Investment Portfolio with ESG-focused Investments | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop delves into the latest trends in sustainability-focused investment strategies and commonly adopted Sustainable and Responsible Investment (SRI) approaches to diversify portfolios. It provides guidance on defining ESG data, indicators and targets for performance tracking, as well as insights into local, regional and global ESG standards and frameworks for best practices in measurement and reporting. |

| Objective | This workshop is designed to equip participants with skills to implement sustainability-focused investment approaches to diversity investment portfolios across local, regional, and global markets by applying effective strategies in sustainable and impact investing. It focuses on obtaining and utilizing ESG data, defining relevant ESG indicators and targets, and evaluating the benefits and challenges of aligning with global ESG standards and frameworks. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | SRI Trends and Themes

|

| 9.30 am | Navigating Various SRI Strategies

|

| 10.45 am | Morning Tea Break |

| 11.00 am | Group Activity and Discussion:

|

| 11.45 am | ESG Data and Indicators for ESG Performance Tracking and Decision Making:

|

| 1.00 pm | Lunch Break |

| 2.00 pm | Group Activity and Discussion:

|

| 2.45 pm | Group Activity and Discussion:

|

| 3.30 pm | Afternoon Tea Break |

| 3.45 pm | Alignment to ESG Standards and Frameworks:

|

| 4.45 pm | Debrief and Wrap Up:

|

| 5.00 pm | End of Programme |

Workshop 4: Structuring Sustainable Bonds and Alternative Investments – Strategies and Methodologies

| Workshop 4: Structuring Sustainable Bonds and Alternative Investments – Strategies and Methodologies | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop provides a deep dive into sustainable bonds, including relevant guiding principles and frameworks to structure and evaluate different types of sustainable bonds. The second half of the programme will cover alternative sustainable investments, as well as the application of selected taxonomies on these investments. |

| Objective | This workshop is designed to equip participants in evaluating the requirements and project eligibility for sustainable bonds and alternative sustainable investments, assessing relevant performance indicators, benefits, impacts, and challenges associated with these instruments. Participants will also be able to apply appropriate frameworks and taxonomies when assessing sustainable bonds and alternative investments. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | Deep Dive into Sustainable Bonds:

|

| 10.30 am | Morning Tea Break |

| 10.45 am | Bond Structures:

|

| 11.30 am | Deep Dive into KPIs and SPTs for Sustainability Bonds:

|

| 12.15 am | Group Activity (30 minutes activity and 15 minutes discussion)

Determine relevant KPIs and SPTs for sample projects that are applying for sustainable bonds and discuss rationale and selection processes applied |

| 1.00 pm | Lunch Break |

| 2.00 pm | Alternative Sustainable Investments:

|

| 2.45 pm | Afternoon Tea Break |

| 3.00 pm | Interoperability of Sustainability-Related Taxonomies

|

| 3.45 pm | Group Activity:

Each group will be assigned a taxonomy and be given a sample list of various sustainable investments proposals. Participants will have to determine the eligibility of the different investments under their taxonomy criteria’s. |

| 4.30 pm | Common Challenges Faced by Financial Institutions

|

| 4.50 pm | Debrief and Wrap Up:

|

| 5.00 pm | End of Programme |

| Workshop 1: Developing Sustainability Assessment Frameworks | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop introduces key components of a sustainability assessment framework that support decision-making across the investment value chain. THis includes tailoring sustainable and responsible investment (SRI) strategies and considerations across different asset classes. |

| Objective | This workshop aims to equip participants with the ability to apply a sustainability assessment framework for investment decision-making, tailoring SRI strategies across different asset classes while ensuring alignment with regulatory requirement, through the investment value chain. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | Key ESG Trends

|

| 9.45 am | Key Components of a Sustainability Assessment Framework

|

| 10.45 am | Morning Tea Break |

| 11.00 am | Group Activity and Discussion:

|

| 11.45 am | Foundational Areas to Enable SRI Implementation:

|

| 12.15 pm | Driving the SRI Mandate:

|

| 1.00 pm | Lunch Break |

| 2.00 pm | Deep Dive into SRI Methodology:

|

| 3.30 pm | Afternoon Tea Break |

| 3.45 pm | Group Activity:

|

| 4.45 pm | Debrief and Wrap Up:

|

| 5.00 pm | End of Programme |

| Workshop 6: Sustainability and Islamic Capital Markets | |

| Methodology | Interactive presentations, activities and question and answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | TBC |

| Overview | This workshop explores the integration of Shariah principles with sustainable and responsible investment SRI), integrating Maqasid Shariah into capital markets, and structuring Shariah-compliant sustainable investments like Green, Social and Sustainability Sukuk (GSSS). The role of Sukuk in achieving ESG goals will be discussed alongside developing a framework for Islamic sustainable finance. Participants will gain foundational knowledge on aligning Shariah with sustainability, focusing on ethical investment practices. |

| Objective | This workshop is designed to examine the connections and differences between SRI and Islamic Capital Market, while applying Maqasid Shariah principles to values-driven decision-making. It also focuses on harmonizing SRI with Islamic Finance, structuring Shariah-compliant investment like GSSS Sukuk and exploring how Sukuk can drive environmental, social, and governance (ESG) objectives. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00 am | Harmonisation of SRI and Islamic Finance: A Comparative Analysis

Group Activity and Discussion |

| 10.45 am | Morning Tea Break |

| 11.00 am | Integration of Maqasid al-Shariah in Islamic Capital Markets

Group Activity and Discussion |

| 11.45 am | Structuring Islamic Sustainable Investments: Challenges and Opportunities

Group Activity and Discussion |

| 1.00 pm | Lunch Break |

| 2.00 pm | Analysing the Role of Sukuk in Sustainable Development

Group Activity and Discussion |

| 3.30 pm | Afternoon Tea Break |

| 3.45 pm | Framing Islamic Sustainable Finance

Case Studies of Successful Sustainable Sukuk Group Activity and Discussion |

| 5.00 pm | End of Programme |

Collaborative Learning Programme Outline

PROGRAMME OVERVIEW

The CCMP-SRI2 Collaborative Learning session engages participants with advanced case studies and real-life scenarios to deepen analysis and discussion on key topics such as sustainability assessment frameworks, ESG (Environmental, Social, and Governance) investments, and SRI (Sustainable and Responsible Investment) strategies. The content will cover a broad range of sectors, including the capital markets industry, financial services, and corporate environments, providing participants with the applicability of sustainability practices across industries.

PROGRAMME OBJECTIVE

This collaborative learning is designed to expose participants to case studies and real-life scenarios enabling them to navigate current issues and developments in sustainability, ESG and SRI.

LEARNING OUTCOMES

By the end of the programme, participants will be able to:

- apply sustainability concepts, frameworks and methodologies aligned to regulatory requirements, standards and best practices in decision making across various industries

- evaluate the issues, developments, and challenges in implementing sustainability agenda within an organisation

- establish procedures and methodologies for structuring sustainability and SRI products

| Case Studies | |

| Overview | The case studies will focus on issues and challenges related to sustainability transformation, sustainability by design, carbon markets, sustainability assessment frameworks and strategies, SRI products, and Islamic capital markets, from both ASEAN and global perspectives. |

| Objective | Upon completion of this programme, participants will be able to:

Evaluate factors to balance financial performance with environmental and social responsibilities |

| Focus Areas |

|

| Scenarios | |

| Overview | The real-life scenarios focus on real-world context through examples and scenarios from local, regional and global organisations. |

| Objective | Upon completion of this programme, participants will be able to:

|

| Focus Areas |

|

Register for the complete CCMP – SRI2 programme to earn the CCMP certification.

| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – SRI2 (Intake 1/2026) |

20 November 2025 |

2 April 2026:

|

View Here |

8,000.00 | Register Here |

|

2 April 2026:

|

Register Here |