10001501887

10001501887

Price Listing

RM 7000 (AM Session)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

RM 7000 (PM Session)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Group Discount

Online

RM 460 (E-Learning Only)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Early Bird

Online

RM 7000 (AM Session)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

RM 7000 (PM Session)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Group Discount

Online

RM 460 (E-Learning Only)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Early Bird

Online

Corporate sustainability has come a long way from the environmental concerns of the 1970s. Today, sustainability is a strategic business consideration driven by various market forces and encompasses environmental, social and governance issues. It poses opportunities and risks to businesses, and defines what growth needs to look like for a sustainable future. Stakeholders are driving this agenda, both as a minimum expectation for business continuity and as a market differentiator for increased competitiveness. This includes, among others:

- An exponentially increasing number of governments who are introducing environmental, social and governance (ESG) requirements and carbon pricing into law,

- Large companies who are relying on their global supply chains to reduce their carbon footprint and to mitigate labour practice risks, and

- Investors and financial institutions who are screening and stewarding key ESG considerations.

Professionals in all sectors and functions today are expected to understand, contribute to, and lead the sustainability pursuits of the company. There is no doubt that sustainability and sustainable finance presents a sharp learning curve, but the ability and speed to gain this understanding is a critical factor of success for companies today.

CCMP-SRI1 is a programme that provides this understanding of sustainability, ESG and sustainable and responsible investment (SRI) which is designed for research analysts, corporate finance advisers, investment product structurers, fund managers, compliance officers, aspiring sustainability analysts, risk managers, other professionals in the capital markets and financial services industry and those involved in investment and asset ownership decision making.

This programme is designed to equip participants with deeper understanding of sustainability, ESG and SRI including concepts, global and regulation requirements, key standards, frameworks, taxonomy, risks, product structuring and the role and importance of sustainable and responsible investments.

Upon completion of this e-learning, participants will be able to:

- Determine key sustainability factors, concepts, principles, strategies and methodologies to assess a corporate sustainability framework

- Apply SRI concepts, principles, strategies and methodologies to integrate and structure basic capital market products according to Malaysian regulatory requirements, established taxonomy, standards and best practices

- Conduct assessment of basic SRI products based on established methodologies, relevant data and criteria to determine compliance or alignment to Malaysian regulatory frameworks, established taxonomy, standards and best practices to advise on product recommendations

- Methodology

- Competencies

- Entry Requirements

- Duration of Modules

- Target Audience

- Completion Requirements

METHODOLOGY

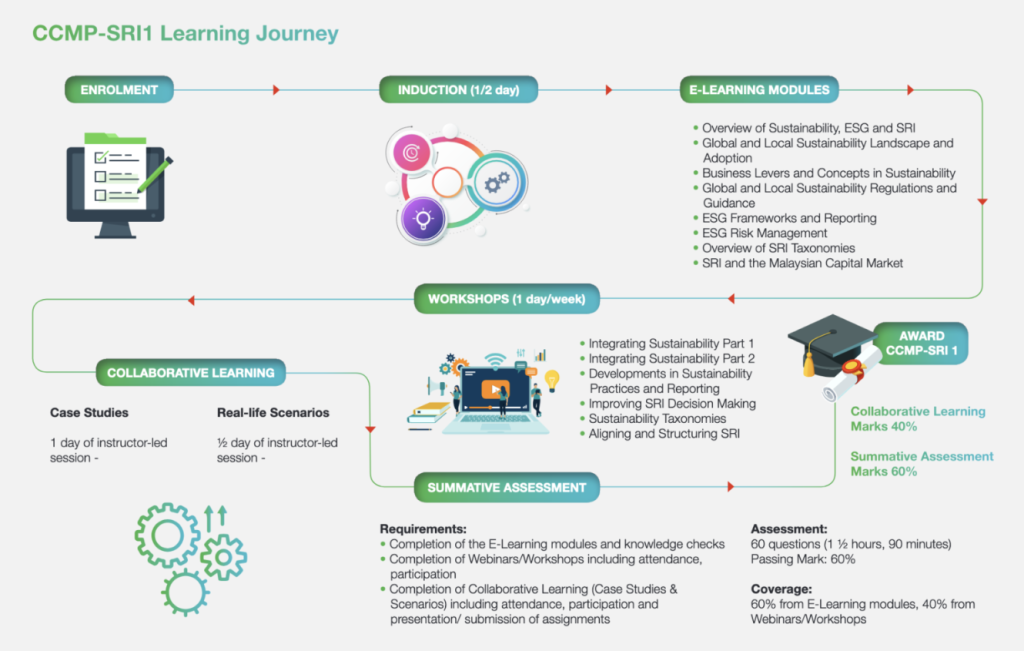

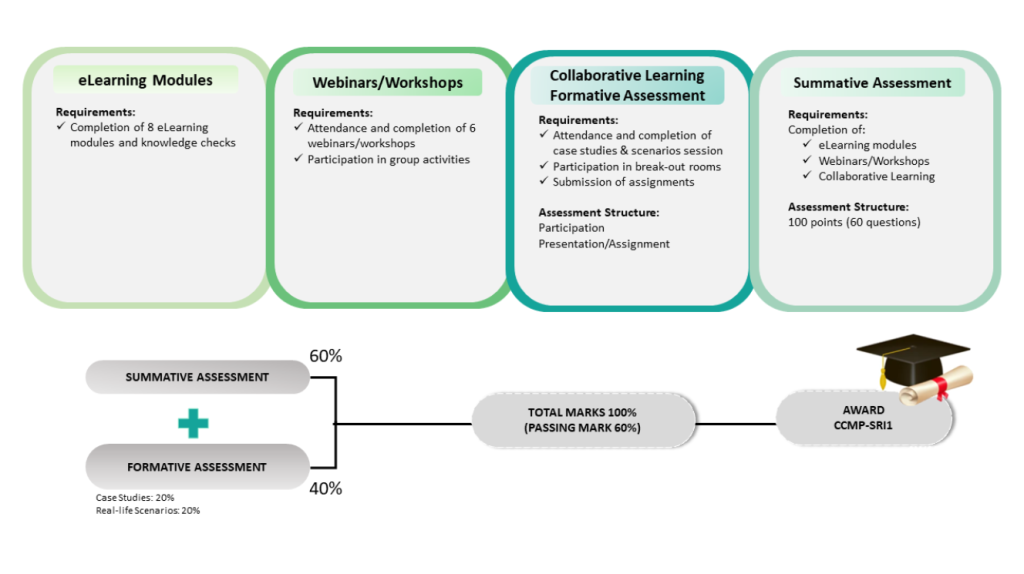

Certified Capital Market Professional – Sustainable and Responsible Investment 1 (CCMP-SRI1) is conducted via blended mode and comprises the following components:

- eLearning Programme (eLearning modules)

- Workshops

- Collaborative Learning

- Assessment

- CC03 Corporate Governance

- FOR05 Islamic Capital Market Regulations

- FOP05 Sustainable and Responsible Investment Products

- FUT10 Sustainability/SRI Analysis

Entry Requirement

- Degree/professional qualification from recognised institution; OR

- Diploma from recognised institution with minimum 3 years relevant capital market and/or sustainability-related experience

DURATION OF MODULES

The total duration for CCMP-SRI1 programme is approximately 12 weeks (3 months).

- eLearning Modules (8 Modules) = 30 minutes per module

- Workshops (6 workshops) = 1-day workshop per week

- Collaborative Learning = 1.5 days

- Summative Assessment = 1.5 hours

TARGET AUDIENCE

Research analysts, corporate finance advisers, investment product structurers, fund managers, compliance officers, aspiring sustainability analysts, risk managers, other professionals in the capital markets and financial services industry and those involved in investment and asset ownership decision making and aspiring new entrants. Sustainability officers, board of directors, senior management, thought-leaders, professionals of public listed companies, small medium enterprises (SMEs)/business owners, C-suites, corporates, government employees and other policy makers and retail Investors will also benefit particularly from the modules in the Essentials of Sustainability and the ESG Risks & Integration buckets.

Completion Requirement

Completion of the programme is upon fulfillment of all requirements below:

- Completion of e-learning modules;

- Completion of workshops;

- Completion of collaborative learning;

- Passing the formative and summative assessments

Programme Overview

This e-learning programme consists of eight (8) modules covering the essentials of sustainability, environmental, social and governance (ESG) risks and integration and sustainable and responsible investment (SRI) product structuring.

Programme Objective

The e-learning programme is designed to equip and provide participants with an understanding on the fundamentals of sustainability, environmental, social and governance (ESG) and sustainable responsible investment (SRI), its concepts, regulatory environment, standards, frameworks, products, and risk.

Learning Outcome

By the end of the e-learning programme, participants will be able to:- Explain key sustainability concepts, principles, practices, regulatory requirements, common standards and best practice methodologies to be integrated into an organisation’s goals and strategy;

- Implement an organisation’s sustainability disclosure and reporting to drive business priorities, manage ESG risks, ensure regulatory compliance, and meet stakeholder expectations;

- Apply SRI concepts, principles and practices to structure capital market products that support economic, environmental, social and governance aspirations, and

- Assess capital market products on their alignment with sustainability principles, objectives, taxonomy and standards based on disclosed information and data.

Modules

Module 1: Overview of Sustainability, ESG and SRI

| Recommended learning hours | 30 minutes |

| Overview | This module provides participants a view of the fundamentals of sustainability, ESG and SRI. As one of the fastest growing transformational corporate concepts in decades, sustainability is becoming a top agenda item of many stakeholder groups. This module defines sustainability and its components to support corporations and the financial sector in making this transition. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover the following:

|

| ICF |

|

Module 2: Global and Local Sustainability Landscape and Adoption

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of sustainability developments globally and in Malaysia. It covers key concepts in the environmental, social and governance pillars. The module details a sustainability adoption methodology that can be employed by corporations for a structured transformation. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 3: Business Levers and Concepts in Sustainability

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of sustainability as a growth strategy; and a review of three opportunity levers for business planning considerations. These three levers can pose a threat or an opportunity and form the basis of the integration of sustainability into core business strategy. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 4: Global and Local Sustainability Regulations and Guidance

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of global and local regulations including the European Union (EU), the United States (US) and Malaysia, as well as a detailed review of disclosure guidance from Securities Commission Malaysia (SC), Bank Negara Malaysia (BNM) and Bursa Malaysia. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 5: ESG Measurement and Reporting

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of ESG data requirements, tracking, disclosure, evaluation and rating; and a detailed review of scoring by rating agencies. This will enable participants to make an informed decision on the selection, disclosure and evaluation of an organisation’s sustainability disclosures. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 6: ESG Risk Management

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of the significance of ESG risk globally and the relevant frameworks to leverage. It provides a general risk framework and discusses the implications of greenwashing. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 7: Overview of SRI Taxonomies

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of global and local SRI taxonomies and how they serve different parties in the alignment of commercial activities. It covers the different taxonomies and presents the underpinning principles. The module also provides guiding steps to help apply a chosen taxonomy. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Module 8: SRI and the Malaysian Capital Market

| Recommended learning hours | 30 minutes |

| Overview | This module provides a view of the varying structures of capital markets in Malaysia, the range of ESG investment approaches, the different types of products and the structuring process and considerations. |

| Objective | At the end of this module, participants will be able to:

|

| Topics | This module will cover:

|

| ICF |

|

Programme Overview

In today’s dynamic landscape, organizations are increasingly recognizing the importance of integrating sustainability into their business strategies. On the other hand, investors are also becoming more aware on the need for sustainable and responsible investments. This increased awareness is driven by deepening understanding on the importance of sustainability and environmental, social and governance (ESG) aspects. There have been rapid developments in the sustainability space including issuances of new frameworks, guidance, and taxonomies where organizations are leveraging these resources to navigate the complexities of sustainable practices within their organizations.

Programme Objective

The workshops are designed to equip and expose participants with in-depth knowledge and application of latest developments in sustainable practices, reporting and taxonomies, integrating sustainability into investment making decisions, and aligning and structuring SRI products.

Learning Outcome

By the end of workshops, participants will be able to:- Apply ESG analysis and integration techniques across various industry sectors for portfolio construction and investment making decisions

- Explain the latest developments in sustainability practices and reporting frameworks

- Apply step-by-step approach in implementing a sustainability programme

- Analyse ESG data using the tools and techniques to provide better investment outcomes

- Explain the role and impact of sustainability taxonomies to the global developments and the application at organisation level

- Apply tools and techniques for SRI Integration into the portfolio management process for various asset classes

Workshops

Workshop 1: Integrating Sustainability - Part 1 (Introduction to Environment, Social and Governance: Factors, Risks & Opportunities)

| Interactive presentations and Question-and-Answer (Q&A) sessions | |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Webinar |

| Overview | This workshop focuses on the core concepts of integrating environmental, social, and governance (ESG) issues in investing. This includes understanding the evolution of ESG considerations, their impact on investment decisions, and the challenges and benefits of adopting ESG. This workshop also covers industry-specific applications and the materiality of ESG issues which includes analysing how ESG factors affect industry and company performance. |

| Objective | This webinar aims to equip participants with a comprehensive understanding of ESG factors, their relevance in investment, and how they can be integrated into investment processes. It also enables participants to apply ESG analysis and integration techniques across various industry sectors, understanding the material impact of ESG factors. |

| Learning Outcomes | By the end of the webinar, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction to ESG in Investing

|

| 10.30am | Break |

| 10.45am | Corporate Pressures & Stakeholder Expectations

|

| 1.00pm | Lunch |

| 2.00pm | ESG Risks

|

| 3.30pm | Break |

| 3.45pm | ESG Reporting and Disclosure

|

| 5.00pm | End of programme |

Workshop 2: Integrating Sustainability - Part 2 (ESG Investing: From Measurement to Management)

| Methodology | Interactive presentations and Question-and-Answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Webinar |

| Overview | This workshop provides participants with the knowledge and skills necessary to effectively integrate environmental, social, and governance (ESG) factors into the investment process. This workshop will cover various aspects of ESG analysis, valuation, integration, and portfolio construction and management, enabling participants to develop ESG-focused investment strategies that align with their clients’ values and financial objectives. Finally, participants will also be exposed to engagement and stewardship approaches to guide their portfolio companies. |

| Objective | This workshop aims to equip participants in applying ESG analysis and integration techniques across various industry sectors for portfolio construction and management. This programme also exposes participants on the various ways to engage with portfolio companies |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction: Insights from the Donut

|

| 10.30am | Break |

| 10.45am | Step 2: Analyse, Value and Integrate

|

| 1.00pm | Lunch |

| 2.00pm | Step 3: Construct Portfolio

|

| 3.30pm | Break |

| 3.45pm | Managing ESG risks and Stewardship

|

| 5.00pm | End of programme |

Workshop 3: Developments in Sustainability Practices and Reporting - Disclosures and Assessment

| Methodology | Interactive presentations and Question-and-Answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Webinar |

| Overview | This workshop provides comprehensive understanding of the latest developments in sustainability practices and reporting focusing on key areas such as environmental, social, and governance (ESG) factors, disclosures, assessment methodologies, and the integration of sustainability into business strategy. |

| Objective | This workshop aims to equip participants with the current trends and developments in sustainability practices, sustainability reporting standards and disclosure requirements and integrating sustainability practices into business operations. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction to Sustainability in Business

|

| 10.30am | Break |

| 10.45am | Sustainability Reporting and Disclosures

|

| 1.00pm | Lunch |

| 2.00pm | Sustainability Programme Implementation (Step-by-step)

|

| 3.30pm | Break |

| 3.45pm | Effective Communication and Stakeholder Engagement

|

| 5.00pm | End of Programme |

Workshop 4: Improving SRI Decision Making - The Quality of ESG Data

| Methodology | Interactive presentations and Question-and-Answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Physical |

| Overview | This workshop aims to improve decision-making in Sustainable and Responsible Investment (SRI) by providing a better grasp of Environmental, Social, and Governance (ESG) data quality from obtaining, evaluating, and using ESG data efficiently in SRI contexts. |

| Objective | This workshop aims to to equip participants on the criticality of ESG data quality in SRI decision-making, provide insights into the challenges adhering to good practice in ESG data quality, variability and interpretation and develop skills for assessing, interpreting, and integrating high-quality ESG data into SRI decision making. |

| Learning Outcomes | By the end of this program, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction to ESG Data in SRI

|

| 10.30am | Break |

| 10.45am | Techniques for ESG Data Analysis

|

| 1.00pm | Lunch |

| 2.00pm | Improving SRI Decision Making with Quality ESG Data

|

| 3.30pm | Break |

| 3.45pm | Navigating ESG Reporting and Standards

|

| 5.00pm | End of Programme |

Workshop 5: Sustainability Taxonomies: Developments Across the Globe

| Methodology | Interactive presentations and Question-and-Answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Webinar |

| Overview | This workshop provides insights on what sustainable taxonomies entail in terms of framework, concept and drivers including SRI focused taxonomies across the globe, as benchmarks for the development of taxonomies in the region and Malaysia. This programme will help participants to advice their organisations on the application of sustainable taxonomies for business strategies and agile models in the pursuit of ESG and better environmental, social and governance practices and aspirations by examining how international corporations are aligning their businesses to global standards and requirements |

| Objective | This workshop aims to equip participants with an in-depth understanding of the role and impact of sustainability taxonomies to the global developments and the application at organisation level |

| Learning Outcomes | By the end of the webinar, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction to Sustainability Taxonomies

|

| 10.30am | Break |

| 10.45am | Market-Based Taxonomies

|

| 1.00pm | Lunch |

| 2.00pm | Applications of SC Principles-Based SRI Taxonomy

|

| 3.30pm | Break |

| 3.45pm | Future Trends and Developments

|

| 5.00pm | End of Programme |

Workshop 6: Aligning and Structuring SRI - Requirements, Methodologies, and Standards

| Methodology | Interactive presentations and Question-and-Answer (Q&A) sessions |

| Competencies |

|

| Duration | 8 hours (1 day) |

| Venue/Mode | Webinar |

| Overview | This workshop is focused on Sustainable and Responsible Investment (SRI), a growing field that combines investors’ financial goals with their concerns about environmental, social, and governance (ESG) issues. This workshop also exposes participants on how a sustainable product is structured, and aligning with sustainability principles |

| Objective | The workshop will equip participants with understanding of the principles and importance of SRI in the modern investment landscape including the regulatory requirements and frameworks, practical methodologies for integrating SRI strategies into investment portfolios, and insights into the standards and best practices for SRI. |

| Learning Outcomes | By the end of the workshop, participants will be able to:

|

| TIME | TOPICS |

| 9.00am | Introduction to Sustainable and Responsible Investment

|

| 10.30am | Break |

| 10.45am | Regulatory Environment and Requirements

|

| 1.00pm | Lunch |

| 2.00pm | SRI Methodologies and Portfolio Integration

|

| 3.30pm | Break |

| 3.45pm | Impact Assessment and Reporting

|

| 5.00pm | End of Programme |

PROGRAMME OVERVIEW

The CCMP-SRI1 collaborative learning will feature case studies and real-life scenarios for participants to discuss and explore how foundations of sustainability, business practices, growth strategies, risk management, regulator’s policies, government incentives and technology affect the implementation of sustainability, ESG and SRI concepts.

PROGRAMME OBJECTIVE

This collaborative learning is designed to provide insights and equip participants an in-depth understanding and approaches in dealing with current issues and developments in sustainability, ESG and SRI through case studies and scenarios ranging from the essentials of sustainability, ESG risks and integration and SRI products and structuring from the Malaysian perspectives.

LEARNING OUTCOMES

By the end of the programme, participants will be able to:- Apply sustainability concepts, frameworks and methodologies in business practices and investment making decisions

- Discuss the issues, developments, and challenges in achieving the sustainability agenda

- Apply key principles in designing SRI products and gain insights into different types of SRI products

Collaborative Learnings

Collaborative Learning – Case Studies

| Overview | The relevance of sustainability is demonstrated through case studies tailored to the Malaysian context. Participants will gain insights into sustainability concepts by examining the impact of business practices, growth strategies, regulatory policies, government incentives, and technology on the implementation of sustainable principles. |

| Objective | Upon completion of this programme, participants will be able to:

|

| Focus Areas |

|

Collaborative Learning – Scenarios

| verview | This programme equips participants with essential sustainability and ESG insights for business and investment, covering foundational concepts, regulatory impacts, and ESG disclosure quality. It emphasizes Sustainable Responsible Investment (SRI), focusing on ESG risk assessment, management, and the design of SRI products aligned with global standards, enabling effective sustainability integration into investment strategies. |

| Objective | Upon completion of this programme, participants will be able to:

|

| Focus Areas |

|

E-learning course is available throughout the year.

| PROGRAMME NAME | FEE (RM) | REGISTRATION LINK |

|---|---|---|

| Sustainability, ESG and SRI Essentials (e-Learning) | 460.00 | Register Here |

| Derivatives E-Learning Series (DEL) | — | Register Here |

| Derivatives E-Learning Advanced Series (DELA) | — | Register Here |

| Anti-Money Laundering (AML) – Fundamentals | — | Register Here |

| Anti-Money Laundering (AML) – Case Studies | — | Register Here |

| Malaysian Capital Market Insights (MCMI) Series | — | Register Here |

| Stock Market and Securities Law E-Learning Programme | — | Register Here |

| Financial Statement Analysis and Asset Valuation E-Learning Programme | — | Register Here |

| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – SRI1 (Intake 7/2025) | 4 July 2025 | 6 October 2025: 10.00am – 11.30am | View Here | 7,000.00 | Register Here |

| 6 October 2025: 2.30pm – 4.00pm | Register Here | ||||

| CCMP – SRI1 (Intake 8/2025) | 20 November 2025 | 26 February 2026: 10.00am – 11.30am | View Here | 7,000.00 | Register Here |

| 26 February 2026: 2.30pm – 4.00pm | Register Here |