10001501900

10001501900

Price Listing

RM 4800 (AM Session)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

RM 4800 (PM Session)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Group Discount

Online

RM 650 (E-Learning Package)

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Early Bird

Online

RM 4800 (AM Session)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

RM 4800 (PM Session)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Group Discount

Online

RM 650 (E-Learning Package)

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Early Bird

Online

CERTIFIED CAPITAL MARKET PROFESSIONAL (CCMP) in Compliance 2

Certified Capital Market Professional (CCMP) in Compliance 2 is designed for compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer.

THE CERTIFIED CAPITAL MARKET PROFESSIONAL (CCMP) IN COMPLIANCE

PROGRAMME IS DESIGNED TO CATER TO VARYING COMPETENCY LEVELS.

Upon completion of this e-learning, participants will be able to:

- Identify the core compliance issues faced in the capital market industry, its implications and the approaches that can be taken to mitigate them

- Explain the importance of compliance and the regulatory requirements applicable to specific regulated activities in the capital market

- Discuss the roles and responsibilities of the compliance function and factors to consider in creating good compliance practices within an organisation and capital market industry

- Develop critical thinking, problem-solving, and communications skills needed by compliance professionals in handling compliance issues and stakeholders involved

- Methodology

- Competencies

- Entry Requirements

- Duration of Modules

- Target Audience

- Completion Requirements

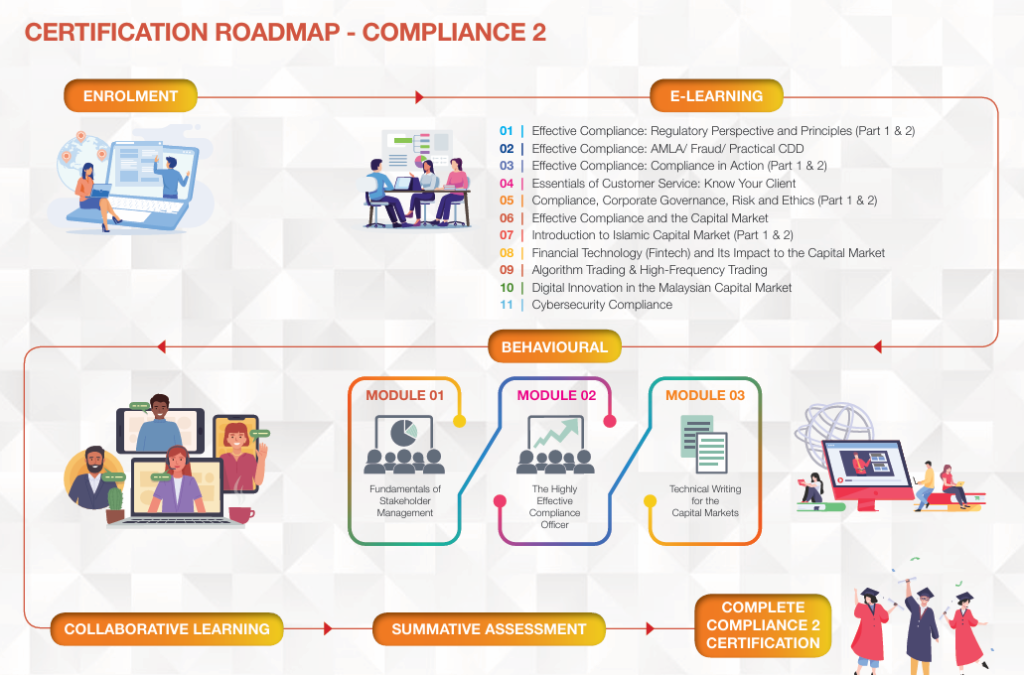

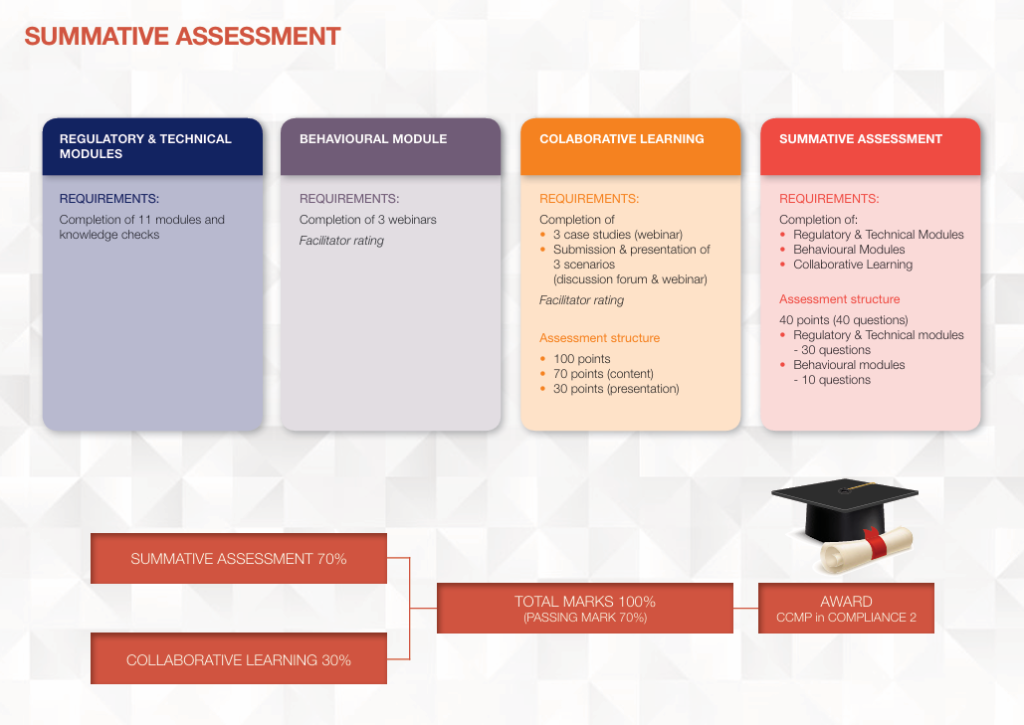

METHODOLOGY

- e-Learning and Knowledge Checks (Regulatory, Technical and Behavioural Modules)

- Webinars (Collaborative Learning case studies, scenarios and presentation)

- Online Summative Assessment (Scheduled and Remote-proctored)

Entry Requirement

- Possess CCMP-C1 qualification; or

- Registered as a Compliance Officer/Head of Compliance with the Securities Commission Malaysia with a minimum of two (2) years of relevant capital market experience.

DURATION MODULES

Estimated duration to complete – up to 4 Months

TARGET AUDIENCE

Completion Requirement

- Completed and passed CCMP-C2 learning and assessment

CCMP-C2, Essentials of Compliance: Case Study Series & Communities of Practice (Real Life Scenarios) will feature real-life case studies and scenarios to discuss and explore the core compliance issues and their implications faced by businesses today. Through discussions participants will deliberate on the approaches taken when faced with similar situations, the rationale behind the decision made, consider on the best compliance practices, as well as learn from others within the industry.

Programme Objective

This programme is designed to give insights and equip participants in the capital market with an in-depth understanding and approaches in dealing with compliance issues through real-life case studies and scenarios ranging from essential compliance concepts, functions, approaches, tools and skillsets on capital market laws, principles and regulatory requirements, technical areas, and general activities of intermediaries.

Learning Outcomes

Upon completion of this programme, participants will be able to:

- Identify the core compliance issues faced in the capital market industry, its implications and the approaches that can be taken to mitigate them

- Explain the importance of compliance and the regulatory requirements applicable to specific regulated activities in the capital market

- Discuss the roles and responsibilities of the compliance function and factors to consider in creating good compliance practices within an organisation and capital market industry

- Develop critical thinking, problem solving, and communications skills needed by compliance professionals in handling compliance issues and stakeholders involved

Case Studies Series

Recommended Learning Hours: 180 minutes (60 minutes for each case)Overview

The 3 cases studies briefly explain the facts in relation compliance issues faced by compliance officers today. Analyse and discuss each situation and its practical in approaching a regulatory breach from a compliance perspective.Objective

Upon completion of this programme, participants will be able to:- Gain a better understanding of governance, risk, compliance and ethics

- Relate the fundamental reasons for compliance to capital markets

- Show the costs of, and the benefits brought by, compliance

- Gain a better understanding of the role and objectives of compliance

- Demonstrate how compliance meets these objectives

- Show how compliance provides assurance, both internally and externally

- Develop knowledge of the thinking and communications skills needed by compliance professionals

- Identify areas where communications are required

- Escalation and reporting requirements

- How to handle breaches, who to involve, and external requirements

Case

This programme will cover:- Effective Compliance: Regulatory Perspective and Principles

- Digital Technology and RegTech

- Advisory and Technical Writing

Communities of Practice (Real Life Scenarios)

Recommended Learning Hours: 120 minutes (3 scenarios per group, presentation of 10 mins per group)Overview

This programme primarily gives an overview on the compliance concepts and issues from real life scenarios perspective and the practical approaches that a compliance officer can take in managing them effectively.Objective

Upon completion of this programme, participants will be able to:- Describe the anti-bribery and corruption requirements of reporting institutions in capital market

- Examine the importance in providing proper client advisory based on customer suitability

- Identifying red flags of a specific example of money laundering

- Discuss on the need of having effective policies to manage potential conflict of interest to safeguard sensitive information

- Recognise the importance of information security reporting requirements and the implications of not reporting breaches to the regulators and exchange on a timely basis

- Describe fair dealing with customers in accordance with the Code of Ethics and Code of Conduct for Capital Markets

- Identifying ransomware red flags as part of cybersecurity awareness

- Recognise the application of a data governance policy and the implications it will have on the organisation.

- Indicate the implications of not performing and reporting reviews on a timely basis

- Explain the concept of 3 lines of defence and the roles of, and expectations of, a compliance and the role of compliance

- Infer the AML/CFT requirements and how they tie to sanctions additional challenges posed by digital onboarding

- Recognise the role of the compliance function, the issues faced by it and how it can add value to an organisation

- Deliberate the different factors, we need to consider in relation to data management

Scenarios

This programme will cover:- Effective Compliance: Regulatory Perspective and Principles

- Digital Technology and RegTech

- Effective Compliance: AMLA/Fraud/Practical CDD

- Effective Compliance: Compliance in Action

- Dealing with Non-compliance

- Monitoring/ Reporting of Intermediary’s Business

- Advisory – Create, promote and cultivate a compliance culture and standards

- Effective Report Writing

- Essentials of Customer Service: Know Your Client

- Client – Review client account opening documentation

- Client – KYC procedures and client account dealing

- Segregation of Duties

- Effective Compliance and the Capital Market

- Financial Technology (Fintech) and Its Impact to the Capital Market

- Education and Training – Ensure adequate training

E-Learning Course

The CCMP in Compliance 2’s E-Learning and Webinars are available as standalone packages. They each consist of all the learning modules and webinars of the respective category.| PROGRAMME NAME | REGISTRATION END DATE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|

| Effective Compliance (formerly known as CCMP in C2) E-Learning Package | All Year Long | 650.00 | Register Here |

Webinar (inc. Certification)

Register for the complete CCMP in Compliance 2 programme to earn the CCMP certification.| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – C2 (Intake 4/2025) | 30 July 2025 | 24 Sept 2025: 10.00am – 11.30am | View Here | 4,800 | Register Here |

| 24 Sept 2025: 2.30pm – 4.00pm | Register Here | ||||

| CCMP – C2 (Intake 5/2025) | 25 Sept 2025 | 26 Nov 2025: 10.00am – 11.30am | View Here | 4,800 | Register Here |

| 26 Nov 2025: 2.30pm – 4.00pm | Register Here |

- Explain the capital market regulatory principles, regulatory expectations on compliance and the roles of business, compliance and internal audit in managing risks

- Discuss the AML/CFT regulatory requirements, ways to manage AML/CFT offences and the impact to business for non-compliance to AML obligations

- Explain the Shariah principles, concepts and products available in the Malaysian Islamic Capital Market

- Describe the fundamentals of FinTech, its developments, key technological drivers and cybersecurity threat threats in building a strong and vibrant FinTech ecosystem.

- Describe algorithmic and high-frequency trading (HFT), its execution and the future challenges of HFT

Advance Module 1: The Highly Effective Compliance Officer

Overview

In today’s dynamic and complex regulatory/business landscape, responding to trends and risks necessitates having highly effective compliance officers equipped with the tools and resources to enhance their skills and influence. Compliance officers are integral to the pursuit of an organisation’s business objectives in supporting and empowering the business to achieve them in an ethically and compliant manner as well embedding ethics and compliance within the organisation’s culture. Highly effective compliance officers are able to position themselves and their compliance programmes as an enabler towards successful realisation of the business objectives whilst ensuring and maintaining compliance. This requires a wide-ranging and advanced skillset that includes knowing the business, stakeholder relations, analytical and strategic thinking and engagement and communication with the regulators.Objective

This course covers knowledge and skillsets for compliance professionals with relevant experience looking to further upskill to enhance effectiveness as a compliance officer. This includes going beyond compliance concepts and frameworks by enabling the compliance professionals to take a practical approach to real life issues encountered in discharging their functions, managing the business of the intermediaries and engagement and communication with the regulators.Learning Outcomes

By the end of this programme, participants will be able to:- Explain the role of a compliance officer in today’s business and regulatory landscape

- Examine the skillsets and attributes that makes a compliance officer highly effective in discharging the functions and managing the business of the intermediaries

- Discuss the elements of good judgement in dealing with issues of business challenges and regulatory expectation

- Discuss the approach on dealings, engagement, and communication with the regulators

Programme Outline

| 8.30 am | Log in to the Webinar |

| 9.00 am | Role of Compliance Officers Today

|

| 10.00 am | Screen Break |

| 10.30 am | The Making of a Highly Effective Compliance Officer

|

| 12.30 pm | Screen Break |

| 2.00 pm | The Making of a Highly Effective Compliance Officer (cont)

|

| 3.15 pm | Screen Break |

| 3.30 pm | Engagement and Communication with the Regulators

|

| 5.00 pm | End of Programme |

Advance Module 2: Technical Writing for Capital Markets

Overview

This course primarily provides participants with the techniques to prepare different types of documentation for different purposes according to capital market activities in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting. Quality technical writing for compliance purposes requires a deep understanding of how the capital market works, how regulations are administered and updated, how normal business practice are done by the capital market players, and ideas of how compliance are bypassed by perpetrators. This helps to uphold a high standard of capital market compliance, to continue best practices in order to reduce the possibilities of non-compliance. Compliance officers need the ability to interpret the regulation, ability to do their own research, more proactiveness on compliance sensitivity, communication with clear information, and avoid any misleading info.Objective

Participants will be able to prepare different types of documents intended for capital market stakeholders in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting.Learning Outcomes

By the end of this programme, participants will be able to:- Collate required information to be included in the compliance documents to meet specific objectives

- Prepare different types of related documents in compliance with industry standards and regulations

- Organise information in written formats using language that can be understood by intended readers

- Examine best practices for technical reports towards improvement of organisational and regulatory reporting

Target Audience

Individuals For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesProgramme Outline

| Registration | |

| 9.00 am | Regulatory Requirements

|

| 10.30 am | Screen Break |

| 10.45 am | Skills for Technical Writing

|

| 1.00 pm | Lunch |

| 2.00 pm | Skills for Technical Writing (2)

|

| 3.30 pm | Screen Break |

| 3.45 pm | Best Practices to Uphold

|

| 5.00 pm | End of Programme |

Advance Module 3: Fundamentals of Stakeholder Management for Compliance

Overview

The role of compliance necessitates an awareness of market and business challenges along with associated opportunities that can be derived successfully by engaging with a multitude of stakeholders. This will allow the merging of regulatory expectations, industry knowledge, experience and the needs of stakeholders to effectively execute the compliance function in the organisation. In this course participants will learn how to identify stakeholders, perform stakeholder analysis, and analyse communications plans and organisational requirements. Participants will also learn different methods of stakeholder engagement and when to utilise them to perform the compliance role effectively. One of the perennial issues for the compliance team is balancing their role between board reporting and communications with senior management. This is in addition to communicating horizontally across the organisation, namely keeping communication channels open to drive and foster a compliance-savvy organisation.Objective

This programme will enable compliance professionals to utilise appropriate strategies, influencing and persuasive techniques and communication tools for stakeholder management in managing compliance matters based on their organisations’ strategies and overall objectives.Learning Outcomes

By the end of this programme, participants will be able to:- Describe the fundamental components of stakeholder management and its importance to the compliance function

- Identify strategies to gain cooperation and support from various stakeholders to meet compliance requirements

- Discuss the importance of maintaining continuous communication with stakeholders in dealing with compliance issues

- Develop a plan on building relationships and networking in the field of compliance

- Determine the success factors of stakeholder engagement to the compliance role

Target Audience

Individuals For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesProgramme Outline

| Registration | |

| 9.00 am | Stakeholder Identification and Analysis for the Compliance Function

|

| 10.30 am | Screen Break |

| 10.45 am | Essential Communications Techniques with Stakeholders

|

| 1.00 pm | Lunch |

| 2.00 pm | Fostering Positive Dialogue with Regulators and Key Stakeholders

|

| 3.30 pm | Screen Break |

| 3.45 pm | Monitoring the Success of Stakeholder Engagements

|

| 5.00 pm | End of Programme |

Advances

Advance 1: The Highly Effective Compliance Officer

Overview

In today’s dynamic and complex regulatory/business landscape, responding to trends and risks necessitates having highly effective compliance officers equipped with the tools and resources to enhance their skills and influence. Compliance officers are integral to the pursuit of an organisation’s business objectives in supporting and empowering the business to achieve them in an ethically and compliant manner as well embedding ethics and compliance within the organisation’s culture. Highly effective compliance officers are able to position themselves and their compliance programmes as an enabler towards successful realisation of the business objectives whilst ensuring and maintaining compliance. This requires a wide-ranging and advanced skillset that includes knowing the business, stakeholder relations, analytical and strategic thinking and engagement and communication with the regulators.Objective

This course covers knowledge and skillsets for compliance professionals with relevant experience looking to further upskill to enhance effectiveness as a compliance officer. This includes going beyond compliance concepts and frameworks by enabling the compliance professionals to take a practical approach to real life issues encountered in discharging their functions, managing the business of the intermediaries and engagement and communication with the regulators.Learning Outcomes

By the end of this programme, participants will be able to:- Explain the role of a compliance officer in today’s business and regulatory landscape

- Examine the skillsets and attributes that makes a compliance officer highly effective in discharging the functions and managing the business of the intermediaries

- Discuss the elements of good judgement in dealing with issues of business challenges and regulatory expectation

- Discuss the approach on dealings, engagement, and communication with the regulators

Advance 2: Technical Writing for Capital Markets

Overview

This course primarily provides participants with the techniques to prepare different types of documentation for different purposes according to capital market activities in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting. Quality technical writing for compliance purposes requires a deep understanding of how the capital market works, how regulations are administered and updated, how normal business practice are done by the capital market players, and ideas of how compliance are bypassed by perpetrators. This helps to uphold a high standard of capital market compliance, to continue best practices in order to reduce the possibilities of non-compliance. Compliance officers need the ability to interpret the regulation, ability to do their own research, more proactiveness on compliance sensitivity, communication with clear information, and avoid any misleading info.Objective

Participants will be able to prepare different types of documents intended for capital market stakeholders in accordance with regulatory requirements, industry standards and best practices focussing on compliance documentation and reporting.Learning Outcomes

By the end of this programme, participants will be able to:- Collate required information to be included in the compliance documents to meet specific objectives

- Prepare different types of related documents in compliance with industry standards and regulations

- Organise information in written formats using language that can be understood by intended readers

- Examine best practices for technical reports towards improvement of organisational and regulatory reporting

Target Audience

Individuals For compliance professionals with relevant experience looking to further upskill their competencies to be more effective as a compliance officer Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesAdvance 3: Fundamentals of Stakeholder Management for Compliance

Overview

The role of compliance necessitates an awareness of market and business challenges along with associated opportunities that can be derived successfully by engaging with a multitude of stakeholders. This will allow the merging of regulatory expectations, industry knowledge, experience and the needs of stakeholders to effectively execute the compliance function in the organisation. In this course participants will learn how to identify stakeholders, perform stakeholder analysis, and analyse communications plans and organisational requirements. Participants will also learn different methods of stakeholder engagement and when to utilise them to perform the compliance role effectively. One of the perennial issues for the compliance team is balancing their role between board reporting and communications with senior management. This is in addition to communicating horizontally across the organisation, namely keeping communication channels open to drive and foster a compliance-savvy organisation.Objective

This programme will enable compliance professionals to utilise appropriate strategies, influencing and persuasive techniques and communication tools for stakeholder management in managing compliance matters based on their organisations’ strategies and overall objectives.Learning Outcomes

By the end of this programme, participants will be able to:- Describe the fundamental components of stakeholder management and its importance to the compliance function

- Identify strategies to gain cooperation and support from various stakeholders to meet compliance requirements

- Discuss the importance of maintaining continuous communication with stakeholders in dealing with compliance issues

- Develop a plan on building relationships and networking in the field of compliance

- Determine the success factors of stakeholder engagement to the compliance role