10001501900

10001501900

Price Listing

RM 3800

Excluding 8% SST

Terms & ConditionsAsk a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

RM 3800

Excluding 8% SST

Ask a consultant

Have questions?

Our dedicated team of specialists are here to help you!

Get in touch and speak to our friendly team:

Our Team |

[email protected] | +603-6204 8941

or find us on:

Normal Price

Online

Certified Capital Market Professional (CCMP) in Compliance 1 is a programme for

aspiring compliance professionals and all employees in the capital market. Covers essential

compliance concepts, functions, approaches, tools, and skill sets related to capital market

laws, principles, and regulatory requirements, technical areas, and general activities of

intermediaries.

Not Applicable

Not Applicable

- Methodology

- Competencies

- Entry Requirements

- Duration of Modules

- Target Audience

- Completion Requirements

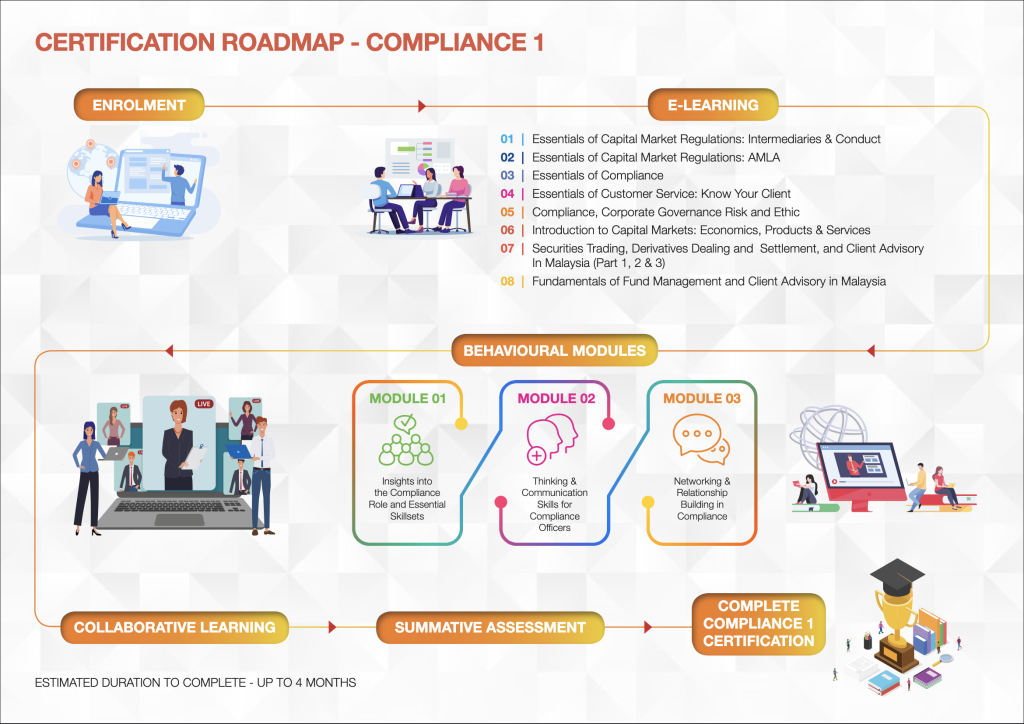

Methodology

- e-Learning and Knowledge Checks (Regulatory, Technical and Behavioural Modules)

- Webinars (Collaborative Learning case studies, scenarios and presentation)

- Online Summative Assessment (Scheduled and Remote-proctored)

- FOR02 Capital Market Institutions

- FOR03 Capital Market Intermediaries

- FOR01 Anti-Money Laundering

- FOR04 Capital Market Products Regulations

- FOP01 Capital Market Environment

- FOP03 Capital Market Products

- FUP03 Compliance

- FUP16 Securities Trading

- FUP17 Settlement of Derivatives Deals

- FUP18 Settlement of Securities Trades

- FUP06 Derivatives Dealing

- FUP14 Know Your Client

- FUP09 Fund Management

- FUT04 Digital Technology Application

- FUT02 Client Advisory (Investment)

- CC01 Customer Focus

- CC02 Ethics and Integrity

- CC03 Corporate Governance

- CC04 Risk Management

- BPM01 Communication

- BPM04 Networking and Relationship Building

Entry Requirement

- Possess a degree / professional qualification from a recognised institution; or

- Possess a diploma from a recognised institution with a minimum 3 years of relevant capital market experience

- For CCMP certifications, you must be at least 21 years old, which is in line with the requirements for a Capital Market Services Representative’s License. The age requirement does not apply for those pursuing modular learning.

Duration Modules

Estimated duration to complete – Up to 4 months

Target Audience

For aspiring Compliance professionals and all employees in the capital market. Covers essential Compliance concepts, functions, approaches, tools, and skill sets related to capital market laws, principles, and regulatory requirements, technical areas, and general activities of intermediaries.

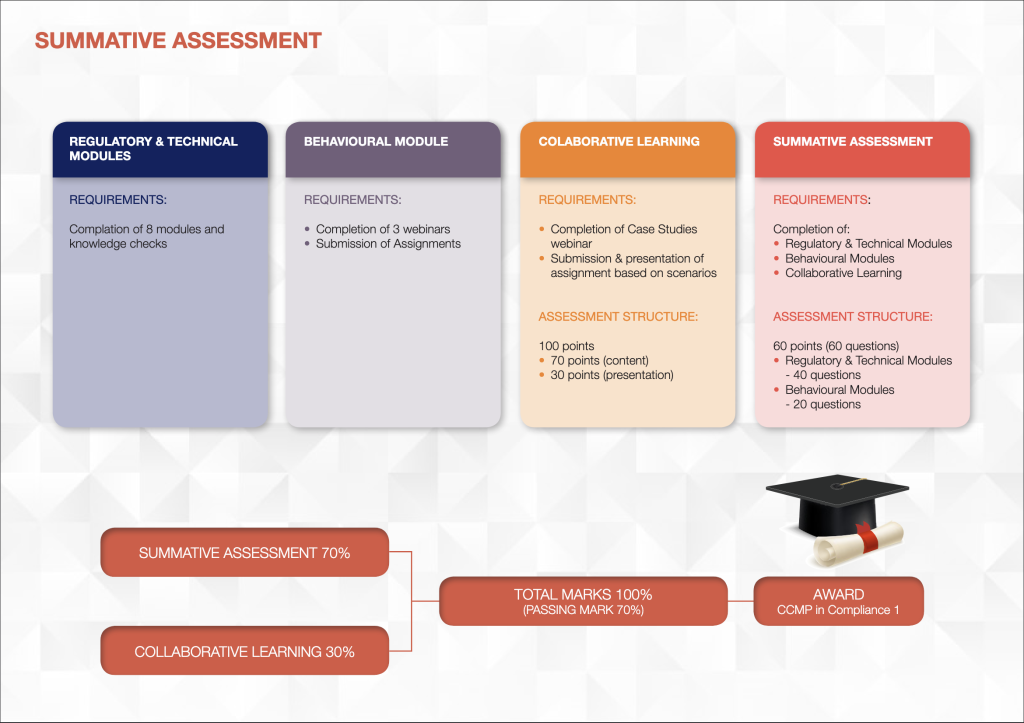

Completion Requirement

- Completed and passed CCMP in Compliance 1 learning and assessment

- Explain the importance of Compliance and the regulatory requirements applicable to specific regulated activities in the capital market

- Identify the roles and responsibilities of the Compliance function and factors to consider in creating an effective Compliance framework

- Recognise emerging risks issues and trends in the capital market industry and the effects of economic changes, monetary and fiscal policies on the capital market environment and businesses

- Describe the regulations and processes related to dealing in securities and derivatives in Malaysia, ranging from advising clients to trading and settlement

- Outline the regulatory requirements and procedures to comply with fund management practices

Modules

Module 1: Essentials of Capital Market Regulations: Intermediaries and Conduct

Recommended Learning Hours: 30 minutesOverview

This course primarily provides an overview of the Malaysian capital market, touching on the various capital market laws and regulations, explaining in detail roles and functions of the entities involved in the capital market (regulators and intermediaries), the rules and regulations applicable to the various regulated activities, function of capital raising, trading, and dealing and the types of offences related to market misconduct and the prohibited conducts.Objective

Upon completion of this programme, participants will be able to:- Describe the roles and functions of the relevant regulatory bodies related to capital market activities

- Explain the regulatory requirements applicable to specific regulated activities

- Distinguish capital market activities that are allowed and restricted, including limitations for the allowed activities

- Outline products, rules and regulations pertaining to regulated activities

- Monitor trades and activities in accordance with applicable procedures and regulations

Topics

This module will cover:- Overview of the Malaysian Capital Market

- Regulation of the Malaysian Capital Market

- Malaysian Capital Market Legal Framework

- Licensing

- Regulated activities definition & roles

- Regulated activities and permitted activities- fit and proper requirements, key management and compliance

- Capital Raising on the Primary Market

- Trading on the Secondary Market

- Derivatives Dealing

- Market Misconduct and other Prohibited Conduct

- Compensation fund: SIDREC

Module 2: Essentials of Capital Market Regulations: AMLA

Recommended Learning Hours: 30 minutesOverview

This course provides participants with an overview of AMLA, its importance and its management to meet legal and regulatory requirements and expectations. It will also enhance participants’ ability to apply appropriate measures to mitigate the money laundering and financing risk in the compliance function.Objective

Upon completion of this programme, participants will be able to:- Explain the requirements under AMLA applicable to capital markets

- Recognise transactions which fall under AML laws and regulation

- Determine processes and practices to detect and prevent AML

- Describe the roles and functions of the relevant regulatory bodies related to capital market activities

Topics

This module will cover:- AMLA Regulatory Framework

- The role and importance of AMLA

- AMLA Guidelines for the Capital Market

- AML Detection and Prevention

- The Compliance Role in AMLA

Module 3: Essentials of Compliance

Recommended Learning Hours: 30 minutesOverview

This course primarily provides an overview on the concept and importance of compliance, the roles and responsibilities of different parties within a firm in relation to compliance, the functions of compliance officers which include providing advisory, compliance review, conducting or assist in conducting compliance training programme and developing a compliance programme. The course also covers compliance issues including the impact of technology on the compliance role.Objective

Upon completion of this programme, participants will be able to:- Identify the roles and responsibilities of the compliance function in the firm

- Analyse the costs and benefits of compliance

- Explain the impact of technological advances which give rise to compliance issues

- Determine factors to consider in creating an effective compliance framework

Topics

This module will cover:- Essential Compliance Concepts and Principles

- Compliance Function – Roles and Responsibilities

- Functions of Compliance Officers

- Costs and Benefits of Compliance

- Rules and Regulations on Compliance

- Compliance Issues and Impact of Technology on Compliance Officers

- Compliance Review

- Essential Framework of a Compliance Programme

Module 4: Essentials of Customer Service: Know Your Client

Recommended Learning Hours: 30 minutesOverview

This course will introduce participants to the concept of effective customer service ranging from customer focus, sales & marketing and know your client and the role of compliance.Objective

Upon completion of this programme, participants will be able to:- Recognise services offered from the customer’s perspective

- Identify appropriate communication style for internal and external customers

- Review and propose actions in KYC processes to enhance customer experience while meeting regulatory requirements

Topics

This module will cover:- Introduction to Customer Focused Services

- Build a customer knowledge set (internal/external)

- Communication Focus (internal/external)

- Dealing with difficult customers and Pro-active Recovery (internal/external)

Module 5: Compliance, Corporate Governance, Risk and Ethics

Recommended Learning Hours: 30 minutesOverview

This course will provide participants with an introduction on the relevance of corporate governance, risk management and ethics & integrity to compliance in the Malaysian capital market. Participants will be exposed to recommended practices of corporate governance, the identification of risk management practices in organisations, the concept and principles of ethics and integrity in relation to overall compliance for the capital market.Objective

Upon completion of this programme, participants will be able to:- Define and outline the principles and requirements of good corporate governance

- Recognise emerging risks issues and trends in the capital market industry

- Identify practices that promote fairness and transparency in dealing with others

- Explain the important elements in the Code of Ethics and Code of the Conduct

Topics

This module will cover:- Corporate Governance Principles, Framework and Practices

- Introduction to Risk Management

- Practice of Risk Management in the Capital Market

- Concept and Principles of Ethics and Integrity

- Code of Ethics and Code of the Conduct for the Capital Market

- The relationship between corporate governance, risk management, ethics and integrity and the compliance role

Module 6: Introduction to Capital Markets: Economics, Products and Services

Recommended Learning Hours: 30 minutesOverview

This course provides an overview of economics, capital market environment, types of the capital market products such as equities, fixed income, derivatives, hybrid securities as well as the money market instrument. The concept of time value of money and basic finance theories will be introduced to gain an understanding on risk and return of capital market products.Objective

Upon completion of this programme, participants will be able to:- Recognise the effects of economic changes, monetary and fiscal policies on the capital market environment and businesses

- Identify factors driving the performance of capital market products

- Distinguish between Conventional and Islamic Capital Market (ICM)

- Explain the risk and return relationship for capital market products

Topics

This module will cover:- Introduction to Capital Market Environment

- Fundamental of Economics

- Capital Market Products and Services (Features, Characteristics and Risk)

- Overview of Risk and Return

- Introduction to Islamic Capital Market

Module 7 (Part 1) : Securities Trading, Derivatives Dealing and Settlements And Client Advisory In Malaysia

Recommended Learning Hours: 15 minutesOverview

This course provides an overview on securities trading and derivatives dealing and settlement in Malaysia, the regulations, the process of trading and dealing in securities and derivatives, dealing with client and the advisory function in relation to dealing in securities and derivatives. This course provides an overview on the regulations and processes related to dealing in securities and derivatives in Malaysia, ranging from advising clients to trading and settlementObjective

Upon completion of this programme, participants will be able to:- Differentiate the obligations and rights between counterparties of a securities trade and derivatives dealing

- Identify products, relevant rules and regulations for securities trade and derivatives dealing and settlement

Topics

This module will cover:- Overview on Securities and Derivatives

- Securities

- Derivatives

Module 7 (Part 2) : Securities Trading, Derivatives Dealing and Settlements And Client Advisory In Malaysia

Recommended Learning Hours: 15 minutesOverview

This course provides an overview on securities trading and derivatives dealing and settlement in Malaysia, the regulations, the process of trading and dealing in securities and derivatives, dealing with client and the advisory function in relation to dealing in securities and derivatives. This course provides an overview on the regulations and processes related to dealing in securities and derivatives in Malaysia, ranging from advising clients to trading and settlementObjective

Upon completion of this programme, participants will be able to:- Explain all deals in the trading system in accordance with procedures and regulations

- Identify the types of trade and margin required for settlements

- Outline the process for payment and transfer of securities stipulated in the rules, regulations and procedures

Topics

This module will cover:- Dealing, Trading and Settlement Process

- Dealing with client on Securities Trading and Settlement Process

- Understanding and interpreting disclosure documents for securities trading

Module 7 (Part 3) : Securities Trading, Derivatives Dealing and Settlements And Client Advisory In Malaysia

Recommended Learning Hours: 15 minutesOverview

This course provides an overview on securities trading and derivatives dealing and settlement in Malaysia, the regulations, the process of trading and dealing in securities and derivatives, dealing with client and the advisory function in relation to dealing in securities and derivatives. This course provides an overview on the regulations and processes related to dealing in securities and derivatives in Malaysia, ranging from advising clients to trading and settlementObjective

Upon completion of this programme, participants will be able to:- Identify and outline the rules and guidelines related to market misconduct, offences and unethical business conduct

- Identify issues arising from Digital Technologies and other technological advancements

Topics

This module will cover:- Client Advisory

- Market Misconduct

- Digital Technology Application

Module 8: Fundamentals of Fund Management and Client Advisory in Malaysia

Recommended Learning Hours: 30 minutesOverview

This course covers the fundamentals in relation to fund management from the rules and regulations applicable to fund management companies to the various theories and methods used for the construction of investment portfolios for clients.Objective

Upon completion of this programme, participants will be able to:- Outline the regulatory requirements and procedures for fund management

- Explain the theories, principles and processes of fund management and the tools to manage a portfolio

- Determine procedures to comply with fund management practices

- Discuss market developments, trends and market data that have an impact on portfolio performance

Topics

This module will cover:- The Fund Management Industry

- Investment Background

- Portfolio Construction

- Monitoring and Review Fund

- Compliance and Risk Management

- Digital Technology Application

Modules

Insights into the Compliance Role and Essential Skillsets

Overview

The changes in today’s regulatory and business environments demands different skills on compliance officers. There is a pressing need to upgrade their skills and influence to manage the ever evolving regulatory changes in the increasingly competitive business landscape. This course provides comprehensive, practical insights and strategies in enhancing the behavioural skills relevant to participants starting out as compliance officers in the capital market. This course focuses on the practical strategies in demonstrating the essential behavioural skills to enable them to discharge their functional and advisory roles effectivelyObjective

This programme will enable participants to recommend an action plan to mitigate compliance issues while anticipating challenges from the business units and communicate with the regulator.Learning Outcomes

By the end of this programme, participants will be able to:- Identify the must-have skillsets for compliance officers

- Describe the role of compliance officers in intermediaries

- Determine individual competency gaps to work on based on the skillsets and role

- Interpret the big picture in determining business and regulatory needs

- Identify issues and challenges surrounding the responsibilities of compliance officers

- Discuss the elements of good judgement in dealing with issues of business challenges and regulatory expectation

- Develop an action plan to affect change towards system improvement

Target Audience

Individuals For aspiring compliance professionals & all employees in the capital market: Compliance Offiers, Dealers, Trading Representatives, Risk Management Officers, Fund Managers and Analysts. Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesProgramme Outline

| Registration |

Overview of Compliance Role and Functions

|

| Screen Break |

Essential Skillsets of Compliance Officers

|

| Lunch |

Compliance in Action

|

| Screen Break |

Implementing the Action Plan

|

| End of Programme |

Thinking and Communication Skills for Compliance Officers

Overview

The key roles Compliance Officers need to focus on are advising, educating and monitoring. Practical skills necessary to carry out the compliance function effectively are thinking and communication skills to interact with all levels of the organisation. This course focuses on participants embarking on the compliance function where they will be exposed to problem solving approaches which would be useful in their roles and responsibilities. Participants will also be able to convey ideas and information by applying the communication process to ensure clarity, persuasiveness and confidence.Objective

This programme will enable participants to recommend a solution for a problem or issue supported by possible options in a given situation related to the compliance functionLearning Outcomes

By the end of this programme, participants will be able to:- Describe thinking and problem solving frameworks and fundamentals

- Determine the steps to enhance thinking skills to assess compliance matters

- Explain the concept and process of problem solving and decision making in overseeing the compliance of the relevant rules and regulations

- Identify potential decision-making strategies in dealing with possible misconduct

- Develop effective communication techniques to manage compliance conversations

Target Audience

Individuals New entrants: Compliance Offiers, Dealers, Trading Representatives, Risk Management Officers, Fund Managers and Analysts. Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesProgramme Outline

| Registration |

Thinking Frameworks and Fundamentals

|

| Screen Break |

Essentials of Problem Solving and Decision Making

|

| Lunch |

Communication for Better Workplace Efficiency

|

| Screen Break |

Managing Effective Compliance Conversations

|

| End of Programme |

Networking and Relationship Building in Compliance

Overview

The compliance unit is essential in any capital market intermediary as it serves to ensure that everyone working in the capital market intermediary adheres to laws and regulation. In order to carry out its function effectively, the compliance unit should establish a strong network and relationship with internal and external parties to ensure the smooth running of the business at the same time comply with laws and regulations. The course will enable participants to create networking opportunities and build relationships with both internal and external parties to enable meaningful conversations on compliance to be carried out. This course introduces techniques and strategies to build confidence in networking among various stakeholders. Participants will take part in discussions, interactive tasks and role plays to immediately put into practice the techniques and strategies taught.Objective

Participants will be able to build effective networks between compliance unit and various stakeholders and avoid the common pitfalls when building business relationships.Learning Outcomes

By the end of this programme, participants will be able to:- Describe the general concept of business networking and its importance in the compliance fraternity

- Explain the process of starting effective networking relationships and building up rapport with counterparties

- Discuss the common pitfalls when building business relationships among different stakeholders

- Apply the appropriate techniques when asking questions to counterparties

- Articulate the importance of establishing meaningful business relationships and effective stakeholder engagement

Target Audience

Individuals For aspiring compliance professionals & all employees in the capital market: Compliance Offiers, Dealers, Trading Representatives, Risk Management Officers, Fund Managers and Analysts. Companies Fund management companies, stockbroking firms, investment banks, alternative financing platforms, startups, exchanges, public listed companiesProgramme Outline

| Registration |

Essentials of Networking

|

| Screen Break |

Building Effective Networking

|

| Lunch |

Expanding and Strengthen Network

|

| Screen Break |

Making Effective Stakeholder Engagement

|

| End of Programme |

Programme Objective This programme is designed to give insights and equip participants in the capital market with an in-depth understanding and approaches in dealing with compliance issues through real-life case studies and scenarios ranging from essential Compliance concepts, functions, approaches, tools and skillsets on capital market laws, principles and regulatory requirements, technical areas, and general activities of intermediaries.

Learning Outcomes Upon completion of this programme, participants will be able to:

- Identify the core compliance issues faced in the capital market industry, its implications and the approaches that can be taken to mitigate them

- Explain the importance of compliance and the regulatory requirements applicable to specific regulated activities in the capital market

- Discuss the roles and responsibilities of the compliance function and factors to consider in creating good compliance practices within an organisation and capital market industry

- Develop critical thinking, problem solving, and communications skills needed by compliance professionals in handling compliance issues and stakeholders involved

Case Studies Series

Recommended Learning Hours: 180 minutes (60 minutes for each case)Overview

The 3 cases studies briefly explain the facts in relation compliance issues faced by compliance officers today. Analyse and discuss each situation and its practical in approaching a regulatory breach from a compliance perspective.Objective

Upon completion of this programme, participants will be able to:- Gain a better understanding of governance, risk, compliance and ethics

- Relate the fundamental reasons for compliance to capital markets

- Show the costs of, and the benefits brought by, compliance

- Gain a better understanding of the role and objectives of compliance

- Demonstrate how compliance meets these objectives

- Show how compliance provides assurance, both internally and externally

- Develop knowledge of the thinking and communications skills needed by compliance professionals

- Identify areas where communications are required

- Escalation and reporting requirements

- How to handle breaches, who to involve, and external requirements

Case

This programme will cover:- Wells Fargo: Corporate Governance, Risk and Compliance Failings

- Amazon data breach: Compliance Officer Functions

- Credit Suisse poor investment credit risk due diligence: Establishing and Monitoring Compliance

- Thinking and Communication Skills – How to be an Effective Compliance Officer

Communities of Practice (Real Life Scenarios)

Recommended Learning Hours: 120 minutes (3 scenarios per group, presentation of 10 mins per group)Overview

This programme primarily gives an overview on the compliance concepts and issues from real life scenarios perspective and the practical approaches that a compliance officer can take in managing them effectively.Objective

Upon completion of this programme, participants will be able to:- Describe the anti-bribery and corruption requirements of reporting institutions in capital market

- Recognise the ESG agenda and its potential implications for all companies, particularly those who are regulated and/or listed

- Explain the use of derivatives in derivatives trading

- Examine the importance in providing proper client advisory based on customer suitability

- Assessing whether a candidate satisfy the Fit & Proper criteria for conducting regulated activities

- Recognise the balance between risk and return and investment suitability based on customers’ risk profile, needs and investment horizon.

- Distinguish the different capital raising options and the main pros and cons

- Discuss the issues around licensing requirements in a country and cross-border basis

- Outline the role of SIDREC and the complaints that can be brought to the SIDREC for dispute resolution and its limitations

- Identifying red flags of a specific example of money laundering

- Discuss on the need of having effective policies to manage potential conflict of interest to safeguard sensitive information

- Recognise the importance of information security reporting requirements and the implications of not reporting breaches to the regulators and exchange on a timely basis

- Describe fair dealing with customers in accordance with the Code of Ethics and Code of Conduct for Capital Markets

- Identifying ransomware red flags as part of cybersecurity awareness

- Recognise the application of a data governance policy and the implications it will have on the organisation.

- Indicate the implications of not performing and reporting reviews on a timely basis

- Explain the concept of 3 lines of defence and the roles of, and expectations of, a compliance and the role of compliance

- Infer the AML/CFT requirements and how they tie to sanctions additional challenges posed by digital onboarding

- Recognise the role of the compliance function, the issues faced by it and how it can add value to an organisation

- Deliberate the different factors, we need to consider in relation to data management

Scenarios

This programme will cover:- Anti-bribery and Corruption

- Environmental, Social and Governance

- Derivatives

- Client Advisory

- Fit & Proper Criteria

- Overview of Risk and Return and Investment Suitability

- Capital Raising

- Regulated Activities and Permitted Activities

- Going to Securities Industry Dispute Resolution Center (SIDREC)

- Anti-Money Laundering

- Managing Chinese Walls and Personal Account Dealing Policies

- Timely Reporting of Breaches

- Treating Customers Fairly: Engaging in Unfair Market Practices

- Identifying Ransomware

- Data Governance

- Reporting of Reviews

- The Compliance Role

- AML/CFT, Sanctions and Digital Onboarding

- The Compliance Role – Cost or Benefit?

- Managing Customer Data

E-Learning Course

| PROGRAMME NAME | REGISTRATION END DATE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|

| Essentials of Compliance (formerly known as CCMP in C1 e-Learning Package) | All Year Long | 550.00 | Register Here |

Webinar (inc. Certificate)

The CCMP in Compliance 1’s E-Learning and Webinars are available as standalone packages. Register for the complete CCMP in Compliance 1 programme to earn the CCMP certification.| PROGRAMME NAME | REGISTRATION END DATE | ASSESSMENT | SCHEDULE | FEE (RM) | REGISTRATION LINK |

|---|---|---|---|---|---|

| CCMP – C1 (Intake 11/2025) | 8 May 2025 | 17 June 2025 10.00am – 12.30pm | View Here | 3,800.00 | Register Here |

| 17 June 2025 2.30pm – 4.00pm | Register Here | ||||

| CCMP-C1 (Intake 12/2025) | 14 Aug 2025 | 23 Sept 2025 10.00am – 12.30pm | View Here | 3,800.00 | Register Here |

| 23 Sept 2025 2.30pm – 4.00pm | Register Here | ||||

| CCMP-C1 (Intake 13/2025) | 2 October 2025 | 25 Nov 2025 10.00am – 12.30pm | View Here | 3,800.00 | Register Here |

| 25 Nov 2025 2.30pm – 4.00pm | Register Here |